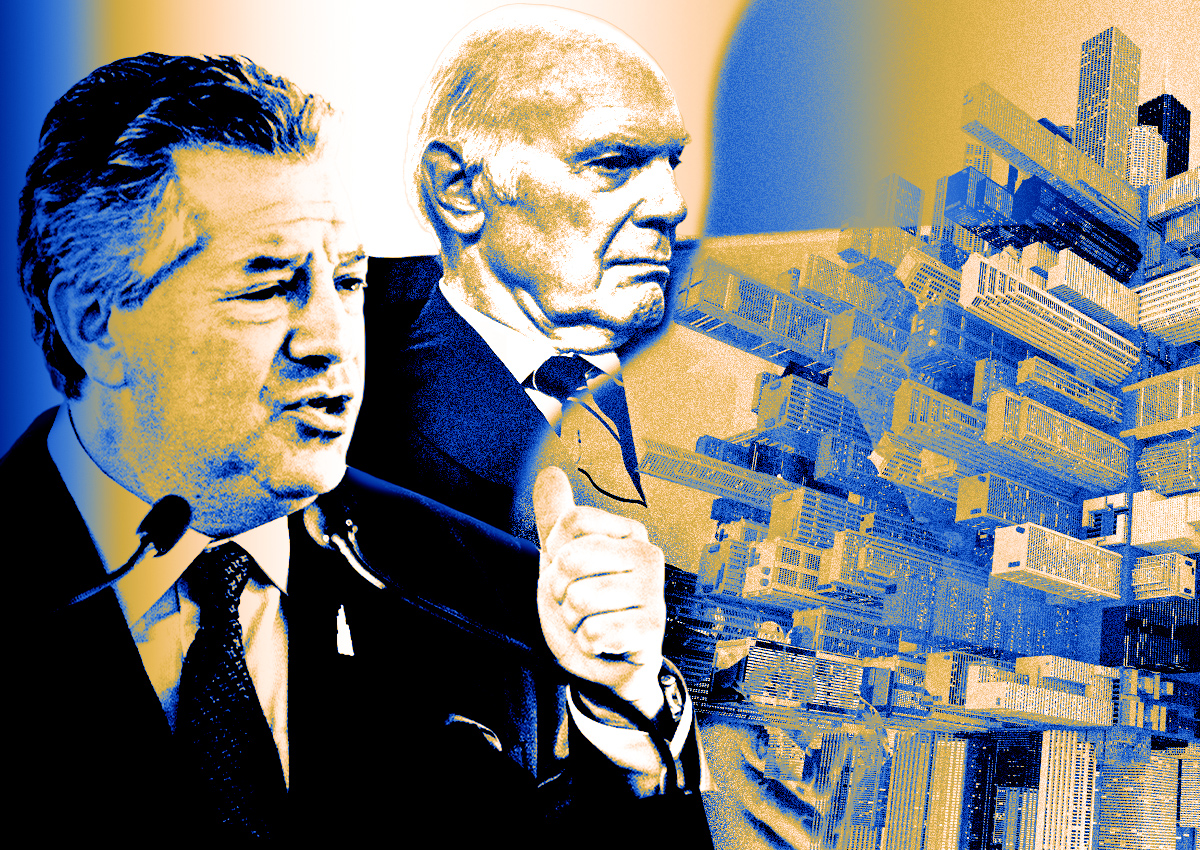

Marc Holliday thinks SL Green’s occupancy has bottomed out.

Occupancy in the REIT’s 33 million-square-foot portfolio slipped to 89.8 percent at the end of June, down from 90.2 percent three months before.

“We expect that to be a low point,” Holliday said on the company’s second-quarter earnings call Thursday afternoon. “We expect to gain occupancy regardless of which way the market goes.”

Holliday said that the company’s leasing pipeline is growing, and if everything falls into place, the company will hit its goal of bringing occupancy back to 92.4 percent at the end of the year.

“If it doesn’t, we’ll be damn close,” he added.

SL Green recorded a large loss of $360 million for the quarter, though the majority of that came from the company writing off its investment in the leasehold at 625 Madison Avenue, where fee owner Ben Ashkenazy recently imposed a substantial rent hike. SL Green had previously announced it would write the investment down to zero, which accounted for roughly $306 million of the quarterly loss.

Outside the writeoff, SL Green saw a loss of about $54 million, compared to the roughly $40 million loss in the first quarter.

While occupancy continued to slide, SL Green has been working to improve its financial position.

The company last month sold a roughly 50 percent stake in its 245 Park Avenue office tower to Japanese investor Mori Trust at a $2 billion valuation. The deal netted SL Green about $174 million in cash and also removed a large piece of debt from the company’s balance sheet.

SL Green also moved up the timeline for when it expects to complete its redevelopment of One Madison Avenue. The company had originally planned to get its temporary certificate of occupancy in December, but is now eyeing the end of September.

Hitting that milestone would trigger a $577 million payment to SL Green from its partners on the project.

Read more