Tavros and Charney’s latest Gowanus project now has something that separates aspiration from reality: a construction loan.

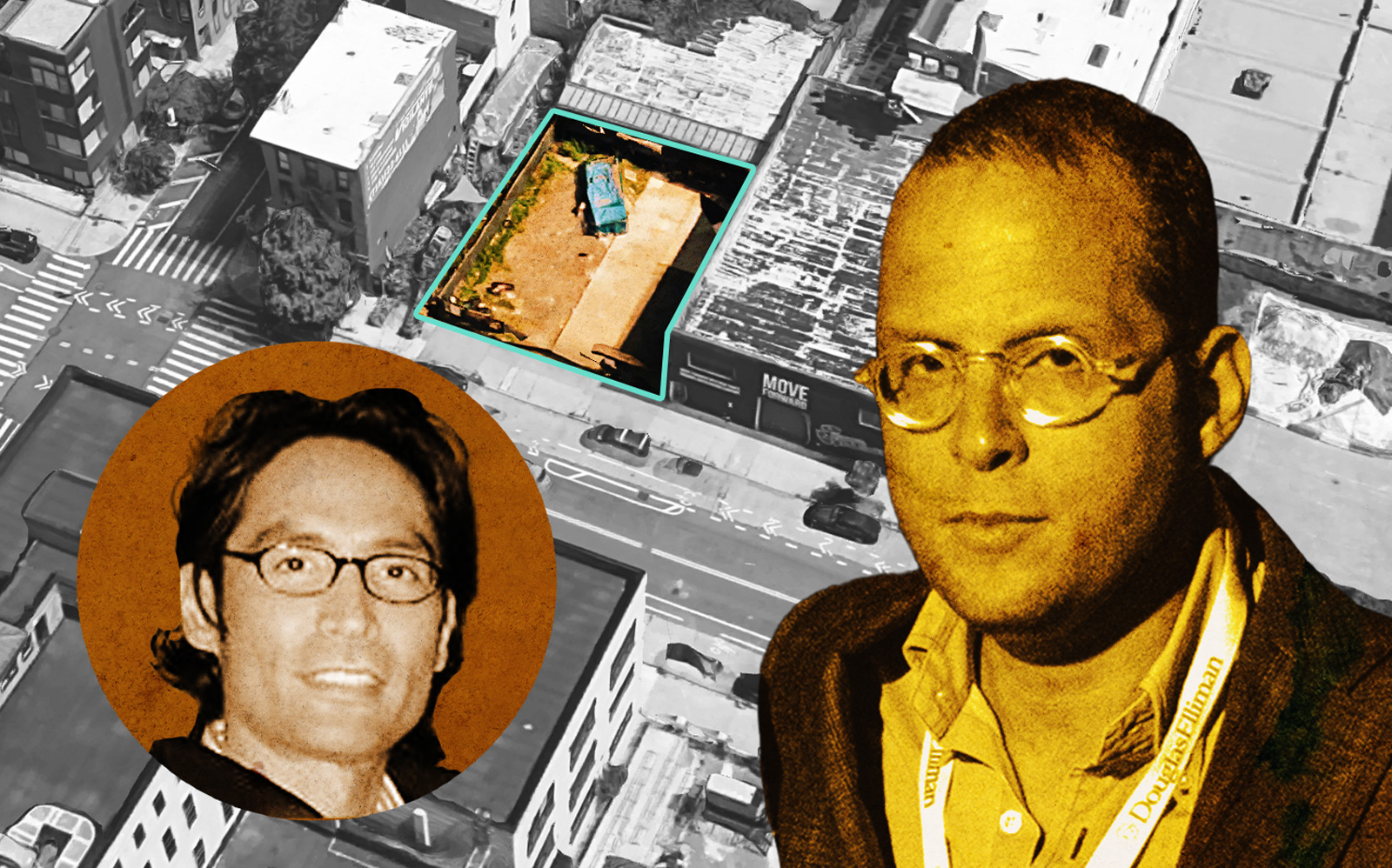

Nicholas Silvers and Sam Charney’s companies nabbed $119.9 million in financing from MassMutual for their planned 261-unit development at 251 Douglas Street in Gowanus, according to public records. PincusCo first reported the loan.

Canyon Partners Real Estate is the lead partner in the project, a spokesperson for Tavros and Charney said. The project’s investors have put in $64.4 million in equity, according to a press release.

It was the eighth largest project filed in November 2021, as developers rushed to beat the expiration of 421a the following June. The plans depict a 15-story, 224,000-square-foot building with about 50,000 square feet of commercial space. Sixty-five of the apartments will be permanently affordable.

Just over half of the 96,884 square feet of built space are office buildings, with industrial buildings making up the other 49 percent.

Newmark’s Jordan Roeschlaub and Dustin Stolly arranged the debt.

Tavros, a New York-based real estate investment management and development firm, acquired the site for $22.5 million in April 2020.

Gowanus is no stranger to Tavros and Charney, who filed plans last year for a project at 318 Nevins Street, three blocks away from the Douglass Street site. And in January, Canyon, Tavros and Charney announced a joint venture to develop 585 Union Street, one block from the Nevins Street project.

Canyon Partners Real Estate is the real estate arm of Canyon Partners, a global alternative asset manager.

Read more

The neighborhood became a hotbed for development as a sweeping rezoning moved slowly but surely toward fruition in the 2010s and passed in late 2021. It got a further boost when Gov. Kathy Hochul announced Gowanus projects could qualify for a tax break akin to 421a, which has a 2026 completion deadline that many projects cannot meet.

It could not immediately be determined if Hochul’s announcement played a role in the loan’s closing, which occurred the following day. Tavros and Charney declined to comment.

Gowanus was the sixth most active neighborhood for development last quarter, PincusCo reported.