Apartment Income REIT (AIR) Communities, a landlord/management division spun off of the national real estate developer AIMCO, has put the final nail in its New York City coffin.

The $8 billion firm has finalized the sale of two properties totalling 62 units in the Big Apple. The transaction grossed $33.2 million, according to SEC filings. The landlord is also in contract to dispose of its final city property with a non-cash “impairment loss” of $15.4 million. it expects that sale to close by the end of the year, according to the company’s Q2 report, noting that the sale will “complete our previously announced exit from the New York market.”

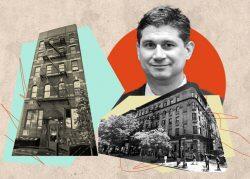

AIR’s last three properties on the market included 237 Ninth Avenue in West Chelsea, 510 East 88th Street in Yorkville and 181-199 Columbus Avenue in the Upper West Side, according to its website.

AIR split off from AMICO in 2020 and has been moving to exit New York for several years, with an eye for sunnier investments in the south. In October 2021, the firm sold 11 buildings on the Upper East and Upper West Sides worth $190 million to Midtown-based investor HUBB NYC.

In June, the Terry Considine-led REIT announced a $1.2 billion joint venture with an unnamed “global institutional investor” to level off debts and expand into southern markets, including Philadelphia, Washington D.C. and San Diego.

Late last year, the firm beefed up its multifamily presence in South Florida, pulling in the 495-unit Southgate Towers for $250.5 million from Gumenick Properties, as well as a $173 million acquisition of The District at Flagler Village at 555 Northeast Eighth Street in Fort Lauderdale.

A few months before that, it scooped up a 28-story, 296-unit tower dubbed the Watermarc in Miami’s Edgewater neighborhood for $211 million, breaking down to $712,838 per unit.

Read more