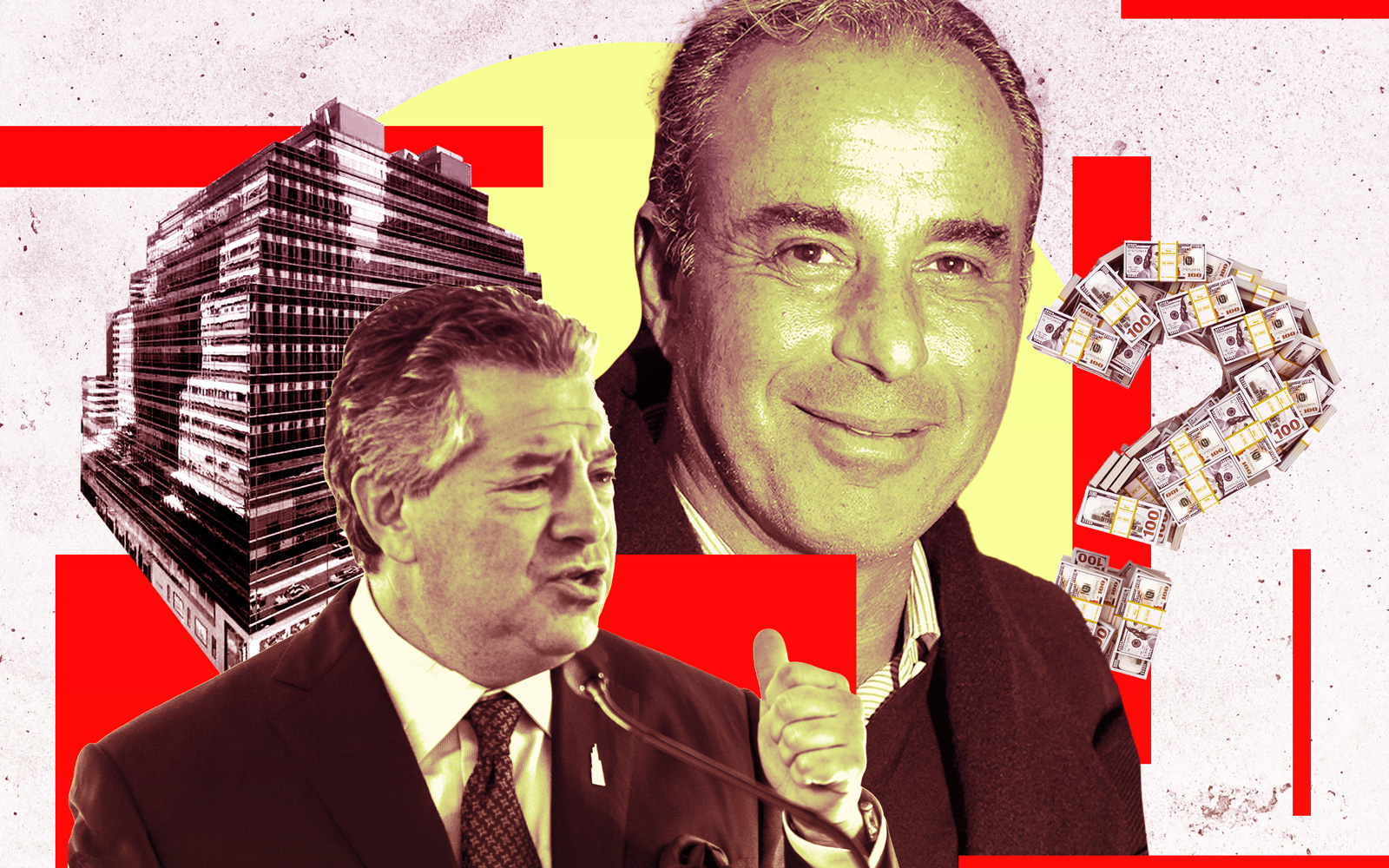

SL Green took over Ben Ashkenazy’s interest at 625 Madison Avenue today — closing a chapter on a years-long dispute over the property and paving the way for what could be big changes at the prime Plaza District site.

The Marc Holliday-led company and its group of lending partners acquired the stake at a UCC auction earlier this morning, according to auctioneer Matthew Mannion of Mannion Auctions. The lenders, who held a $195 million mezzanine loan that Ashkenazy used to finance the property, moved to foreclose in June.

A representative for Ashkenazy did not immediately respond to a request for comment, and a spokesperson for SL Green declined to comment.

The question now: What will become of the 17-story, 1950s-era office building between East 58th and 59th streets, a block away from Central Park?

Ashkenazy purchased the ground underneath the building in 2013 for $400 million — a price that indicated he was eyeing a large increase when the rent reset in 2020. SL Green, which controlled the building under a long-term lease, was paying just $4.5 million at the time, and Ashkenazy’s team floated the idea it could jump to as high as $80 million.

Read more

That number was partially based on the view that the best use for the property would be to tear down the office tower and build high-end condos with Central Park views a la the buildings rising around Billionaires Row.

As the rent dispute heated up, SL Green in 2019 bought a stake in the lending group that provided Ashkenazy with his mezzanine loan, which includes the U.K.-based Children’s Investment Fund and Winthrop Realty Trust.

An arbitrator earlier this year set the rent at $20.25, which triggered SL Green to write its investment in the ground-lease from more than $230 million down to zero. But now that the REIT owns a stake in the ground as well as the leasehold, the company and its partners have more control over the future of the site.

SL Green and its partners are now responsible for the $194 million CMBS loan on the fee position.

A team at Newmark handled the marketing process for the UCC sale.