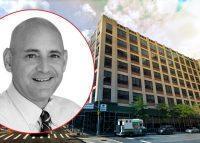

LoanCore Capital carried out its threat to make Dune Real Estate Partners sell a Plaza District office building, then bought it at the foreclosure auction.

The lender acquired 111 East 59th Street late last month, PincusCo reported. Dune defaulted on $193.4 million in loans, so LoanCore could bid with the debt it was owed. The deed transfer value, a technical matter, was $5 million.

A year ago, LoanCore sued the owners of the office and retail property to force a sale. A state judge ordered that sale after LoanCore filed to foreclose on the loan, which had an initial principal of $196 million.

LoanCore did not immediately respond to a request for comment. Dune could not immediately be reached for comment.

In 2015, Dune partnered with Princeton International Properties and Empire Capital Holdings to buy the 15-story, 200,000-square-foot building from Lighthouse International for $170 million. The joint venture planned to convert the lower floors to attract a big-box retail tenant.

Two years later, LoanCore provided a $195 million financing package. On top of a previous $103 million loan, the financing included a $50 million mortgage and several consolidations with existing loans. At the time, the owners were in the midst of a $20 million capital improvement, though the aim shifted from big-box retail to a medical facility conversion.

Princeton and Empire exited the picture in 2018.

LoanCore alleged Dune defaulted in September 2020. Other issues have emerged, including the expirations of a temporary certificate of occupancy and the building plumber’s insurance, which led to a stop-work order.

Tenants at the property include Premier Medical Group and a cashier-less Starbucks. It’s unclear what LoanCore plans to do with it.

Read more

Prior to the pandemic, LoanCore provided $181 million to Taconic Investment Partners and Nuveen to finance their purchase of the West End campus that used to be part of the ABC portfolio.

Early last year, Dune teamed with Turnbridge Equities to buy two vacant warehouses in Brooklyn’s Canarsie neighborhood, planning to redevelop an industrial property without a tenant in place.

— Holden Walter-Warner