Trending

At White Castle site, a Brooklyn real estate dream dies

False starts, high leverage undo Art Deco project in Borough Park

Old assemblages never die, they simply fade away.

At a busy intersection in Borough Park, Samuel Pfeiffer and his wife Dina Krausz saw their fortune in a plot where a White Castle restaurant served its famously devoted fans, who cherished the fast-food chain’s sliders on Valentine’s Day in particular.

Pfeiffer and Krausz had established themselves in the working-class Brooklyn neighborhood with a modest condo project at 1044 42nd Street, with four units priced at a total of $1.8 million. By the time the project sold out in the late 2010s, the couple was looking for something larger.

They did not have to look far.

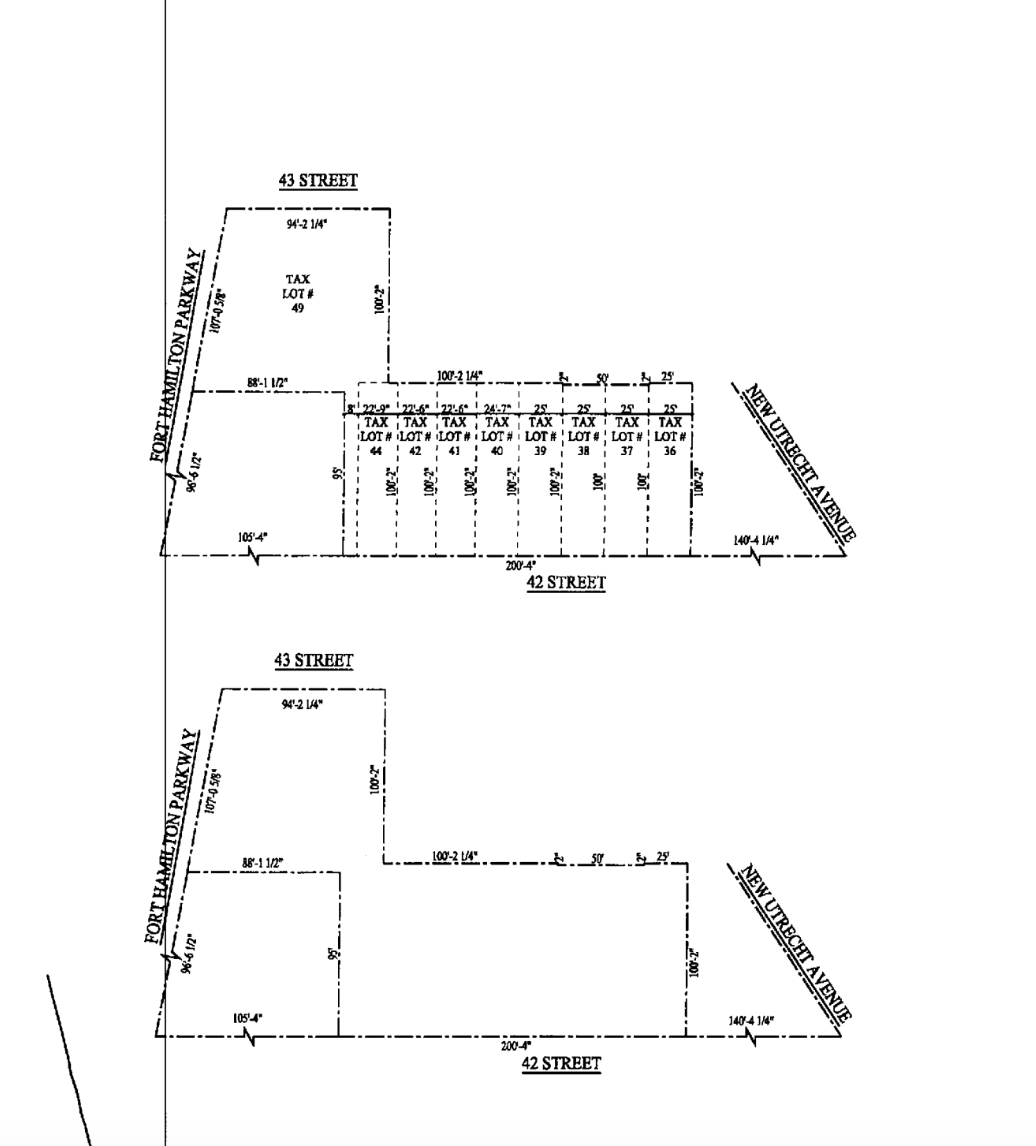

On the same block, at Fort Hamilton Parkway and 42nd Street, Pfeiffer, who also goes by Shabsi, amassed two more properties including the White Castle and filed plans for an 18-story residential building. Renderings show an Art Deco design.

Today, almost a decade after Pfeiffer demolished the White Castle, hardball lenders have taken back the assemblage, leaving industry veterans to scratch their heads at the long and winding project, which never landed a construction loan.

“Usually it’s pretty straightforward,” said Greg Corbin, who guided one of Pfeiffer’s properties through bankruptcy. “But this was more a case of ‘the dog ate my homework.’”

Corbin described the situation as “shady, but not in an illegal way.”

In 2005, investors led by Abraham Wieder went into contract to buy the White Castle property, at 4202 Fort Hamilton Parkway. Twelve years later, they still had not closed, and acquisition costs had ballooned to $14 million from $6 million, sources told The Real Deal in 2017.

Wieder, who has claimed to have a portfolio of 5,000 apartments, has been sued for more than $40 million in unpaid mortgages. After a recent spree of multifamily acquisitions, at least three of his properties have spiraled into decline, dragged down by inadequate upkeep and unpaid debt.

To close the White Castle deal, Pfeiffer, Wieder’s apparent partner, got $10 million from Eli Tabak’s Bluestone Group, a distressed-debt investor whose loan was meant to jumpstart an office project on the site. A veteran player, Bluestone recently flipped a coveted portfolio on Manhattan’s west side to Extell Development.

Pfeiffer’s next move came a year later, buying the neighboring 4218 Fort Hamilton Parkway using $8.3 million from Joseph Oved’s Ice Cap Group. The hard money loan covered more than 95 percent of the sale, an exceptionally high figure. The lender advertises providing “aggressive leverage” to borrowers.

With Pfeiffer and Krausz in control of all three sites, they merged unused floor area, doubling the allowable size of a development at the corner of 43rd Street and Fort Hamilton Parkway to 103,000 square feet, according to Frank Chaney, a zoning attorney at Rosenberg & Estis.

Plans for the 18-story residential project were approved by the city in 2019, but without construction financing, Pfeiffer defaulted on its mortgage from Bluestone. In 2020, as the first Covid cases popped up in the city, the site headed to auction. Last week, Bluestone finally took possession of the property.

Pfeiffer and Wieder could not be reached through their attorneys. Bluestone did not respond to a request for comment.

In separate bankruptcy proceedings, Pfeiffer faulted Ice Cap for the eventual default at 4218 Fort Hamilton Parkway, alleging that the lender reduced its financial commitment just one day before Pfeiffer’s deadline to close on the property.

Maguire Capital Group, which declined to comment, bought the debt from Ice Cap in 2019, taking over the project through bankruptcy in August.

Despite Pfeiffer’s transfer of development rights to what is now Maguire’s property, bankruptcy courts appear to have nipped in the bud any legal dispute between it and Bluestone. The two parties gave up legal claims to the air rights transfer, court documents show.

Bluestone and Maguire may now seek to sell the parcels individually. If they sold to separate buyers, that could snuff out the possibility of a large building on the site.

Elsewhere in Borough Park, there are signs of further trouble for Wieder and Pfeiffer.

Pfeiffer signed for nearly $12 million in loans secured by 5601 13th Avenue, a vacant lot owned by Wieder where the Department of Buildings has stopped the construction of a seven-story, mixed-use building, citing outstanding civil fines owed to the city.

Read more