Brooklyn developer Yoel Goldman has been banned from raising money from Israel’s capital markets for five years.

Goldman, who raised hundreds of millions of dollars through the Israeli bond market, reached a settlement with the Israel Securities Authority over allegations he misled investors, according to a report in the Israeli publication Calcalist. As part of the settlement, Goldman has to pay more than $2 million U.S. dollars, or 9 million Israeli Shekels, to bondholders and cannot serve as an officer of a public company for one year.

The settlement ends a criminal investigation into Goldman, according to Calcalist. Prosecutors dropped the investigation due to concerns of jurisdiction, since the developer is an American citizen. Extradition could also prove challenging, the publication reported.

Trustees of some Israeli bondholders protested the settlement, but Israel’s securities regulator upheld the settlement in October.

Goldman, nor his attorney, returned a request for comment.

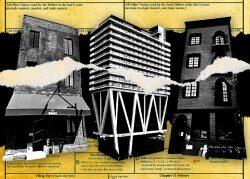

Goldman’s rise and fall in New York real estate was truly remarkable. Based out of South Williamsburg, Goldman built much of his empire by acquiring walk ups across North Brooklyn around the great recession. He then tapped into the Israeli bond market to finance some of the area’s most ambitious projects: The 911-unit Denizen rental complex in Bushwick and The William Vale Hotel in Williamsburg with his partner Zelig Weiss.

Despite his fast rise and young age, no photo existed of Goldman online and few outside of Brooklyn’s tight-knit real estate community knew of his stature.

Goldman’s empire showed cracks around 2019. All Year’s British Virgin Islands–registered bond-issuing entities reported hefty losses because of changes in the value of its investments and financing costs. Investors were spooked when All Year disclosed it accidentally transferred about $3.7 million to Goldman’s personal account.

Along the way, Goldman became entangled in legal battles with partners including Weiss, Heritage Equities’ Toby Moskovits.

All Year unraveled during the pandemic. Lenders initiated foreclosures across the portfolio. Issues were compounded by All Year’s high leverage and the firm’s byzantine structure, where Goldman used a web of entities levered with varying types of debt.

“[Goldman] has all the information in his head,” Joel Biran, the chief restructuring officer appointed by Israeli stakeholders, said at a meeting, The Commercial Observer reported in 2021. “If it were up to me, I would use the time to do a download of what’s in his head.”

All Year eventually stopped making payments to bondholders. Restructuring officers took over and put the firm into bankruptcy in 2021. Through bankruptcy, All Year sold most of its assets with the exception of the William Vale hotel. Goldman owned properties outside of All Year. Goldman said he planned to buy four properties that were within the All Year portfolio.

Goldman is still involved in numerous lawsuits in the U.S. One of his lawyers at Blank Rome recently requested to withdraw as his counsel in a New York lawsuit.

“Blank Rome has not been able to get in contact with plaintiff Goldman for several months despite multiple attempts,” the attorneys wrote in a filing.

Read more