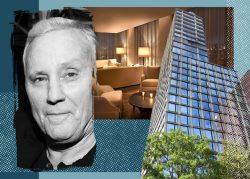

Ian Schrager and Steve Witkoff have a plan to avoid foreclosure at the Public on the Lower East Side. But one of the luxury hotel’s investors, worried about the impact on its stake, is suing to block the deal.

Schrager and Witkoff are working with their lender Varde Partners to convert some of the 367-room hotel’s $90 million distressed debt into equity, according to a lawsuit filed by one of the property’s investors.

A November email indicates that the developers planned to swap up to $30 million of Varde’s debt into equity, giving the Minneapolis-based investment manager a 45 percent stake in the property.

But the New York City Regional Center, an EB-5 manager that raised nearly $80 million from for the project, says the developers have left the investors “flying in the dark” because they refuse to share details.

The center filed a lawsuit last week claiming that Schrager and Witkoff need its approval to negotiate any deal. The fund manager said it’s not clear exactly how the equity would fit into the capital stack, but fears that Schrager and Witkoff would dilute its position.

“A glance at the JV’s organizational chart and the maze of joint ventures therein demonstrates that defendants have a consistent practice of introducing equity interests in the JV and the Public hotel through the creation of joint ventures,” the lawsuit claims.

Representatives for Schrager, Witkoff and Varde did not immediately respond to requests for comment.

The partners developed the 26-story building at 215 Chrystie Street, which also includes 11 condominium units, and upon completion in 2017 refinanced it with a $177 million loan from Deutsche Bank and Aareal Bank and a $60 million mezzanine loan from Korean lender Shinhan Investment Corporation.

Varde later acquired the mezzanine loan and last year started a UCC foreclosure.

Read more

This is not the first time the EB-5 fund has butted heads with Schrager, who co-founded Studio 54 as a junior lawyer in 1974, and Witkoff.

The fund had sued the high-profile developers in 2021, claiming they siphoned money from the hotel. The judge dismissed the case in July. The fund in August filed notice that it planned to appeal the decision, but has not filed paperwork to do so.