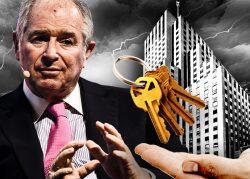

The special servicer of Blackstone’s debt at 1740 Broadway is taking another shot at selling the mortgage.

Midland Loan Services, a division of PNC Bank, tapped JLL to sell the $308 million loan backed by the Midtown Manhattan office property located near 56th Street, Bloomberg reported. JLL is marketing the debt, which is packaged into a commercial mortgage-backed security, at a 50 percent discount.

A few months ago, Midland reportedly hired CBRE to sell the mortgage, only to pull it from the market shortly thereafter. Market conditions may be more advantageous today, as the Federal Reserve has paused interest rate hikes and even signaled future cuts, which could help thaw commercial real estate transactions and debt deals out of a deep freeze.

Blackstone defaulted on the loan backed by the 26-story office property nearly two years ago, handing over the keys to the special servicer in March 2022. Despite Blackstone’s decision, Midland hasn’t foreclosed on the property, one of the more common outcomes after the keys are handed over.

Deutsche Bank originated the loan as part of a CMBS single-asset, single-borrower transaction in November 2015. Green Loan Services was previously the special servicer, though it’s unclear when PNC’s Midland took over. PNC did not immediately respond to a request for comment from The Real Deal.

The 621,000-square-foot building has dealt with a rash of tenant departures in recent years. At the start of the pandemic, L Brands decided to downsize and relocate, leaving behind 418,000 square feet. Before that, law firm Davis & Gilbert left for Rudin’s property at 1675 Broadway.

Blackstone acquired the property from Vornado Realty Trust in 2014 for $605 million. The most recent appraisal for the property came nine months ago, when it was valued at $175 million.

“We wrote this property off two years ago, and in the event a buyer is identified, we will work collaboratively to transfer the ownership,” a Blackstone spokesperson said.

One possibility being floated for the property is an office-to-residential conversion, which could be more viable because of the deep discount being offered on the loan.

— Holden Walter-Warner

Read more