After a rough few years, Nir Meir reached a new low this week: He filed for bankruptcy in Florida.

Meir, the former HFZ executive said he had no income, $30 million in liabilities and just $50 in cash to his name. But it beats a possible alternative: jail.

Israeli businessman Yoav Harlap sought to impose sanctions against Meir for failing to resolve contempt charges related to a $19 million judgment Harlap has against Meir. In August, New York State judge Joel Cohen found that Meir moved $1.1 million out of restrained accounts and held him in contempt of court. To get out of it, Meir was supposed to pay the $1.1 million to Harlap by September.

But that never happened. Meir also allegedly failed to pay about $600,000 he owed Harlap from another contempt order.

“Meir has proven through his actions that nothing short of the loss of his liberty will compel him to comply,” said Harlap’s attorney Mark Hatch-Miller in a court filing. “The court must now use all of its available remaining powers to try to compel Meir’s compliance.”

The bankruptcy will delay Meir’s hearing, but maybe not for long.

Meir and his lawyer did not respond to a request to comment. Hatch-Miller declined to comment, as did HFZ Capital.

Meir, who was known for hosting $10,000 sushi dinners in the Hamptons during his days at HFZ, now claims to be unemployed. He lists his expenditures of $37,400 a month, including $10,000 for child care and $4,000 for food and housekeeping supplies. He lists his address as the 1 Hotel and Homes in Miami Beach.

The bankruptcy also lists claims against HFZ Capital, his former partner Ziel Feldman, Ziel’s son Adam Feldman and Ziel’s wife Helene Feldman. In addition, it alleges Meir has a claim against the Witkoff Group and the firm’s president, Scott Alper.

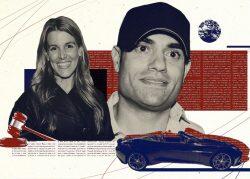

Meir’s latest financial troubles could affect his contentious divorce case in Miami. His estranged wife, Ranee Bartolacci, claims that Meir kept her in the dark about their legal troubles, notably a $13 million judgment against her.

She alleges Meir was partying, drinking and borrowing money from her father while racking up debts and putting others in her name. Meir argued that his wife put her head in the sand and tried to pin the blame on him.

“I’m not surprised. He waited until the very last minute to avoid the inevitable,” said Dan Rottenstreich, who represents Bartolacci, about the bankruptcy filing. “But all it will do is just buy him another 60 to 90 days. His day will come.”

Meir’s fall from the No. 2 at one of New York’s largest luxury condo developers to a man running from creditors is a storyline fit for an HBO drama.

After leaving HFZ Capital, Meir moved to Miami Beach, where he lived in luxury. Lawsuits accuse him of splurging on fine wine, buying $1.5 million worth of gold, chartering private jets and yachts and staying at the Four Seasons.

Ziel Feldman filed his own lawsuit against Meir accusing him of stealing money from HFZ and once hiring someone to fake a Korean accent to convince an investor that a term sheet for a fake Korean investment was real. Meir denied the allegations, asserting that Feldman knew what was happening in his own company.

Read more