The $77 million loan backed by two Chetrit Group mixed-use properties transferred to special servicing this month, after sponsor Jacob Chetrit failed to make a debt payment in January, according to Morningstar Credit.

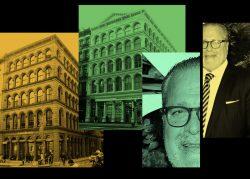

The debt is collateralized by 459 Broadway (also known as the Devlin Building) and 427 Broadway, two five-story Soho buildings with office and retail space.

A spokesperson for Chetrit did not respond to a request for comment.

This wasn’t the first time Chetrit has fallen behind on its debt payments. But it is the first delinquency that is not tied to low occupancy.

The landlord previously struggled with vacancy since American Apparel filed for bankruptcy in 2017 and shuttered its 13,000-square-foot store at 427 Broadway.

Chetrit briefly achieved full occupancy at both properties in 2019 before the pandemic served a second blow, dragging occupancy down to just 33 percent by the end of 2020, according to Morningstar. Meanwhile, property taxes and utility costs jumped and the loan’s debt service coverage ratio slipped to 0.7. A figure below 1 shows revenue cannot cover monthly debt payments.

By the end of 2021, the sponsor had failed to improve occupancy and fallen behind on loan payments twice in as many years.

Over the next two years, Chetrit slowly inked new tenants and in November 2023 reported a recovered occupancy of 100 percent across both properties.

It’s unclear what drove the most recent delinquency; though, higher expenses could be the catalyst. Chetrit paid for building repairs and “professional fees,” this summer, which contributed to a “one time” increase in costs, according to Morningstar.

In September, the properties’ DSCR was still below breakeven.

The debt doesn’t come due for 11 more months, meaning Chetrit could hammer out a modification. Securitized loans must go to special servicing to be worked out.

This article has been updated to remove a reference to 850 Third Avenue, which is affiliated with the Chetrit Organization, not the Chetrit Group.

Read more