RXR Realty is getting a boost from Bank OZK in Red Hook.

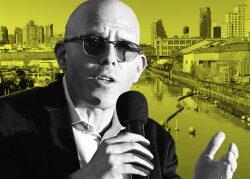

The Arkansas-based bank provided Scott Rechler’s firm a $62 million building loan for an industrial project at 722 and 730 Court Street in the Brooklyn neighborhood, public records show. The bank has provided financing at several turns for the project, which hasn’t been in the public eye in recent years.

A spokesperson for RXR said the filing is for an existing construction loan and is related to the finalization of tax lots for privately owned streets.

At the tail end of 2021, RXR and LBA Logistics acquired 760,000 square feet on the Gowanus waterfront from Houston-based Buckeye Partners, an eight-property portfolio that cost the developers $123 million. Bank OZK provided a $73.8 million acquisition loan to the partners.

In October 2022, the partners received $79.7 million in construction financing from the same institution to build the industrial property near the mouth of the Gowanus Canal. The joint venture filed plans for a one-story building at 730 Court, zoned for manufacturing use.

This isn’t the first play RXR and LBA have made in the outer-borough logistics space. They also joined forces on a 1.1 million-square-foot, five-story logistics center at 55-15 Grand Avenue in Maspeth, Queens.

New York City’s industrial sector is in an awkward spot. The vacancy rate in the sector stands at 4.8 percent, hovering around the average of recent years. The leasing velocity in the first quarter was 1.1 million square feet, according to CBRE, which was 300,000 square feet above the three-year rolling average.

But absorption was flat, leaving the vacancy rate struck in neutral. There is more than 4.4 million square feet of industrial space set for completion this year, but only 35 percent is pre-leased as demand softens after the industrial market’s pandemic boom.

Bank OZK also recently provided SMA Equities $62 million in construction financing for a 157-unit multifamily project in Lower Manhattan, one of the last projects to qualify for the old 421a tax abatement, according to the Commercial Observer.

This story has been updated with more information about the $62 million loan.

Read more