Rabsky Group scored a sizable loan for its hulking Gowanus project.

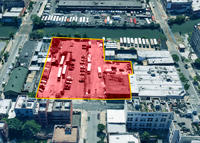

The Brooklyn-based developer inked a $286 million construction loan for its 604-unit multifamily building at 313 Bond Street from G4 Capital, according to a source familiar with the deal.

Rabsky, led by Simon Dushinsky, will use the loan to build its 567,000-square-foot rental complex next to the Gowanus Canal. Dushinsky is one of many developers who have capitalized on a 2021 rezoning in the formerly downtrodden, industrial neighborhood to build apartments.

Henry Bodek of Galaxy Capital arranged the financing.

G4 Capital had provided a $92 million pre-development loan for the project in 2022.

Rabsky bought the site from Yoel Goldman’s All Year Holdings for $95 million in 2019. Goldman had acquired the site a year earlier for $61 million. All Year has since filed for bankruptcy and sold off most of its assets.

Rabsky has become one of the largest developers in Brooklyn. He recently bought the Nassau Brewing redevelopment at 945 Bergen Street in a bankruptcy auction. The firm is also branching out to other states. It is seeking to build a 1,100-unit residential development in Fort Lauderdale.

Though the Gowanus rezoning is ahead of projections in its promise to deliver 8,500 homes, a number of projects were in jeopardy because of a June 2026 completion deadline to qualify for the 421a tax break. But the state extended the deadline last month to 2031.

Read more