The Alexico Group successfully refinanced the luxury Mark Hotel again. This time, the loan appears to carry good news for the landlord.

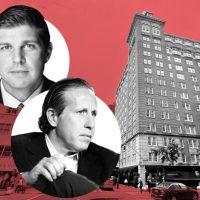

Izak Senbahar’s firm scored a $335 million loan for the famed Upper East Side property at 25 East 77th Street, the Commercial Observer reported. The refinancing first came to light in a Bloomberg CMBS pricing alert.

A $300 million commercial mortgage-backed securities loan provided by Goldman Sachs makes up the bulk of the financing. The remaining $35 million is mezzanine financing held outside of the CMBS trust. The senior loan comprises a floating-rate, single-asset, single-borrower transaction expected to close in about a week.

Newmark’s Jordan Roeschlaub and Jonathan Firestone were part of the team to arrange the transaction.

Alexico last refinanced the 153-key property in 2022, also leaning on the CMBS market then. That debt was originally scheduled to mature earlier this month, but the maturity date had been extended three years, according to a Fitch Ratings presale report.

That debt was critical in Alexico’s fight to stave off foreclosure. Early in the pandemic, Ohana Real Estate Investors moved to foreclose on the five-star hotel after Alexico allegedly missed multiple payments on a mezzanine loan. A judge postponed a scheduled auction and Alexico ultimately managed to refinance the asset and hang on to the hotel.

Read more

Previously, Alexico refinanced the hotel with $230 million from JPMorgan Chase in 2017 and $265 million overall, replacing a $200 million loan from TPG Real Estate Finance. The jump in the loan size from then suggests the hotel is considered to be much more valuable than it was seven years ago.

While high interest rates and the cost of capital have done a number on hotel valuations across the country, New York’s hospitality industry is on an upswing. The city’s Local Law 18 has crushed the short-term rental industry, while competition for existing hotels is controlled by a 2021 law requiring a special hotel construction permit.