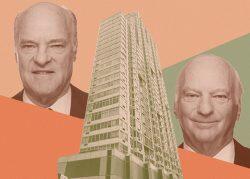

In a discounted sale on the Upper West Side, Dalan Management and Elion Partners unloaded two partially rent-stabilized buildings for 35 percent less than the team paid six years ago.

Danny Wrublin‘s Dalan, a repeat partner of KKR’s, and Elion sold 2568 Broadway and 226 West 97th Street for about $43 million to Nathan Benelyahou’s NJB Management Corporation.

The properties are only about one-third rent-stabilized, which Benelyahou pegged as a positive.

“Kind of rent-stabilized is the key,” he said, noting that the properties are generating cash “very nicely” and the ground-floor retail is “great.”

The extent to which the 2019 Housing Stability and Tenant Protection Act devalued rent-stabilized buildings has depended on how many market-rate units a property has to offset the revenue restrictions on stabilized ones.

The ratio at 2568 Broadway and 225 West 97th probably doesn’t explain the drop in sale price as much as the rise in cap rates does. Investors have demanded higher returns since interest rates began rising in early 2022, meaning they will pay less for buildings relative to their rent revenue.

Benelyahou noted that a number of the buildings’ units are rent-controlled, meaning they have exceptionally low, grandfathered rents under the system that preceded rent stabilization. In larger buildings like the ones Benelyahou bought, when such units become vacant they get a fair-market rent and transition to rent stabilization.

Wrublin declined to comment on the deal, but the prospect of refinancing might have influenced the sale. Dalan took out a $38.5 million senior loan in June 2018, property records show. Many multifamily mortgages are seven years, the first five of which are interest-only. After that, they begin to amortize, so payments spike.

Benelyahou has done other rent-stabilized deals in recent years. Last summer, his firm paid $9.5 million for 2794 Broadway, a 13-unit building with three rent-stabilized units.

“That was an identical idea,” he said. “Strong retail, good free-market, a little component of stabilized.”

NJB also bought 61 East 75th Street, another partially rent-stabilized building, in May 2022 for $4.4 million. The strategy there was a gut rehab, Benelyahou said.

Substantial renovation is one of the last avenues owners have to destabilize units. But Benelyahou said, “We didn’t vacate any existing stabilized tenants.”

“We’re not the type of landlord that’s going in there guns blazing trying to kick out tenants,” he added. “That’s just not our business model.”

This article has been updated to reflect that Elion Partners teamed with Dalan on the deal.

Read more