Jay Martin spends a good portion of his day beating back false narratives about rent-stabilized housing.

Indeed, that is a full-time job. How many headlines did you see about the Rent Guidelines Board reducing rents? Not one, although Martin has repeatedly insisted that regulated rents have fallen over the past few years, adjusted for inflation.

On his weekly podcast, the executive director of the Community Housing Improvement Program, which represents owners of rent-stabilized buildings, sounds frustrated as he tries to counter all the spin.

But Martin sometimes employs spin himself.

On a recent edition of the podcast, he took issue with an article in The City about the loss of rent-stabilized units. “Regulated Apartments Vanish at Rising Rate,” the headline blared.

Martin noted that the reported departure of 9,694 units from rent regulation represented just 1 percent of the city’s rent-stabilized housing stock. (He might have said that the story failed to mention how many such units were added, though it did say developers got permits for 85,015 units of all kinds in 2022 and 2023. Some will be rent-stabilized because of 421a requirements.)

So far, so good. But When Martin got to the subject of “Frankenstein” units — those created by combining apartments, which allows for an increase to market-rate rent — he gave what seemed like a disingenuous rationale.

“One of the things we see is that in response to renter demand, property owners were actually combining rent-stabilized units,” he said. The common claim that landlords are doing so only to collect more rent, he said, is “rhetoric.”

If something walks like a duck and talks like a duck, it’s almost always a duck. It seems foolish to argue that the ability to reset the rent was anything short of 99 percent of landlords’ motivation. (By the way, rent resets for combining units are now banned.)

While it’s true that the city has a shortage of large apartments, its shortage of small ones might be even more severe. Landlords can always find tenants for permanently rent-stabilized units, big or small: Their vacancy rate is under 1 percent.

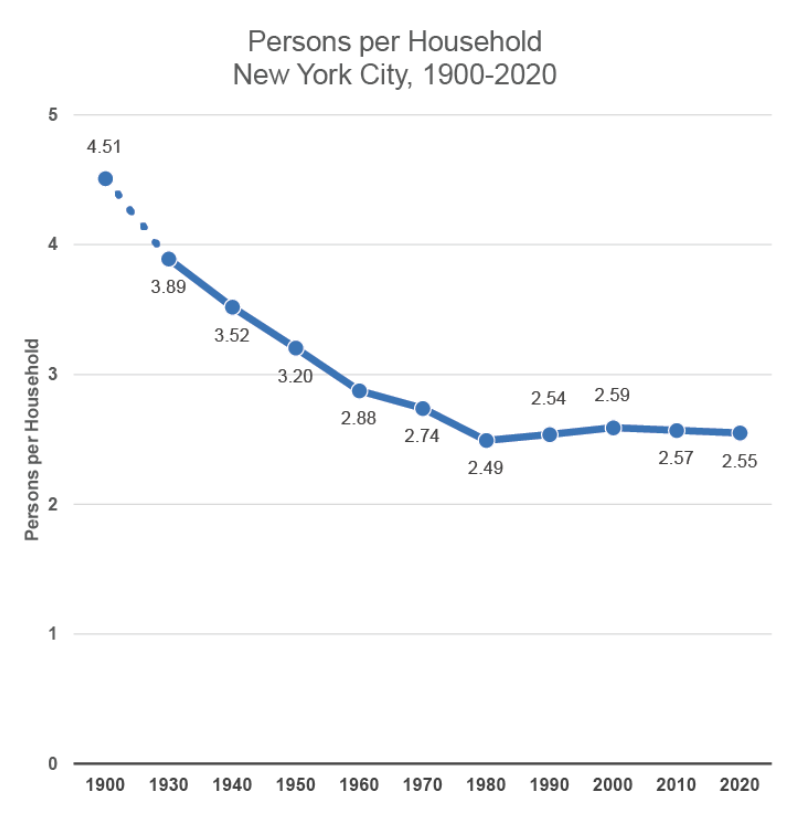

Moreover, contrary to Martin’s statement that apartments must be larger now, household size plunged from 1900 to 1980 and has been basically flat since:

It’s not clear why Martin should hide the fact that landlords respond to financial incentives. After all, they are capitalists, and as he often points out, rent-stabilized housing is private and not subsidized.

It would make more sense to say landlords must take advantage of rare opportunities to boost rents because the Rent Guidelines Board’s increases never keep pace with inflation.

What we’re thinking about: Will activists complain when the new developer of Pacific Park (perhaps Related) gets an extension of the impossible-to-meet 2025 deadline to build nearly 900 affordable units? Email me at eengquist@therealdeal.com.

A thing we’ve learned: About one-quarter of Staten Island residents identify as Italian, making Richmond County No. 2 in the U.S. in that category, according to the Department of City Planning’s Population FactFinder, now updated with 2020 census data. Putnam County, a northern suburb of the city, is No. 1, at 27 percent.

Elsewhere…

— A 1973 New York Times article reported on New York University’s efforts to evict three elderly women from a student dorm at 55 East 10th Street where they had managed to live for more than 30 years. The property’s acquisition and renovation was financed by the state Dormitory Authority and thus could only be used as a dorm. “We have been evading a state dormitory rule for eight years and we can no longer get around it,” James Hester, NYU’s president, told the Times. “We just have no choice in the matter.”

Judging from their rather humorous quotes in the story, the three seniors felt right at home with the students, and vice versa. “Girls come to me all the time, asking advice about their boyfriends and other problems,” said one. She was also teaching students ceramics.

— City Council member Julie Won is working with the Department of City Planning on a rezoning that could allow for another 14,000 homes in her Queens district. But Won, who tried to kill a rezoning for Silverstein Properties’ $2 billion project Innovation QNS, remains leery of the real estate industry. She recently told block party attendees that she was pushing legislation to “curb real estate speculation,” Gothamist reported. Speculation is industry opponents’ word for investment.

— Most New Yorkers seem to view the city’s high housing costs as a choice by landlords and developers or just an immutable reality. But not Dan Garodnick, the Adams administration’s planning director, who points his finger at government decisions made over many decades.

“This housing crisis has been going on for so long that some take it as a fact of life that New York City is a place where rents always go up, where housing is always hard to find,” Garodnick said this spring. “But that is a policy choice.”

Closing Time

Residential: The priciest residential sale Friday was $3.3 million for a 2,311-square-foot condominium at 142 Clymer Street in South Williamsburg.

Commercial: The largest commercial sale of the day was $25.8 million for an 11,300-square-foot development site at 2468 Tiebout Ave in Fordham Heights. DOB permits state the project will be 44,244-square-foot and will contain residential and community space.

New to the Market: The highest price for a residential property hitting the market was $21 million for a 10,500-square-foot townhouse at 18 East 76th Street in Lenox Hill.

Breaking Ground: The largest new building application filed was for a 96,780-square-foot, eight-story residential building at 344 Carroll Street in Carroll Gardens. Amy Shakespeare of Shakespeare Gordon Vlado Architects filed the permit. — Matthew Elo