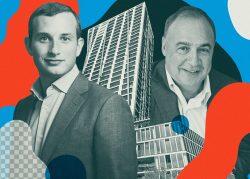

Steve Witkoff and Len Blavatnik landed a $1 billion refi on the High Line condo project that a few years ago symbolized HFZ Capital’s downfall.

Witkoff Group and Blavatnik’s Access Industries secured the $1.15 billion loan for their One High Line development from JP Morgan and Tyko Capital, the developers announced Friday.

It’s one of the largest single-asset loans of the year.

“The closing of this significant construction loan represents the support and confidence our financial partners have in our proven track record as well as this remarkable building,” said Alex Witkoff, Steve’s son and co-CEO of Witkoff Group.

One High Line, spanning a full block next to the elevated park at 500 West 18th Street, includes 236 condos across two towers and a planned 5-star Faena Hotel. The developers said they have closed more than $800 million in sales during the first half of the year — making One High Line the top selling new development in the city.

A Walker & Dunlop team led by Aaron Appel and Keith Kurland arranged the financing.

It’s an important milestone for the project, which at one point appeared as though it might end up as one of the biggest busts in New York history.

Ziel Feldman’s HFZ Capital Group bought the site in 2014 for around $870 million — north of $1,000 per square foot. That price, as well as the long time it would take to sell so many units, raised concerns that the project was too risky.

Feldman’s company collapsed (his former partner, Nir Meir, is in jail on Rikers Island for allegedly masterminding a fraud that helped bring the company down) and his lender — the UK hedge fund The Children’s Investment Fund — filed to foreclose in 2021.

Witkoff and Blavatnik came in and took over the project later that year.

Read more