The owners of a Midtown office building tangled in distressed debt and foreclosure proceedings are trying to squeeze lemonade out of a lemon.

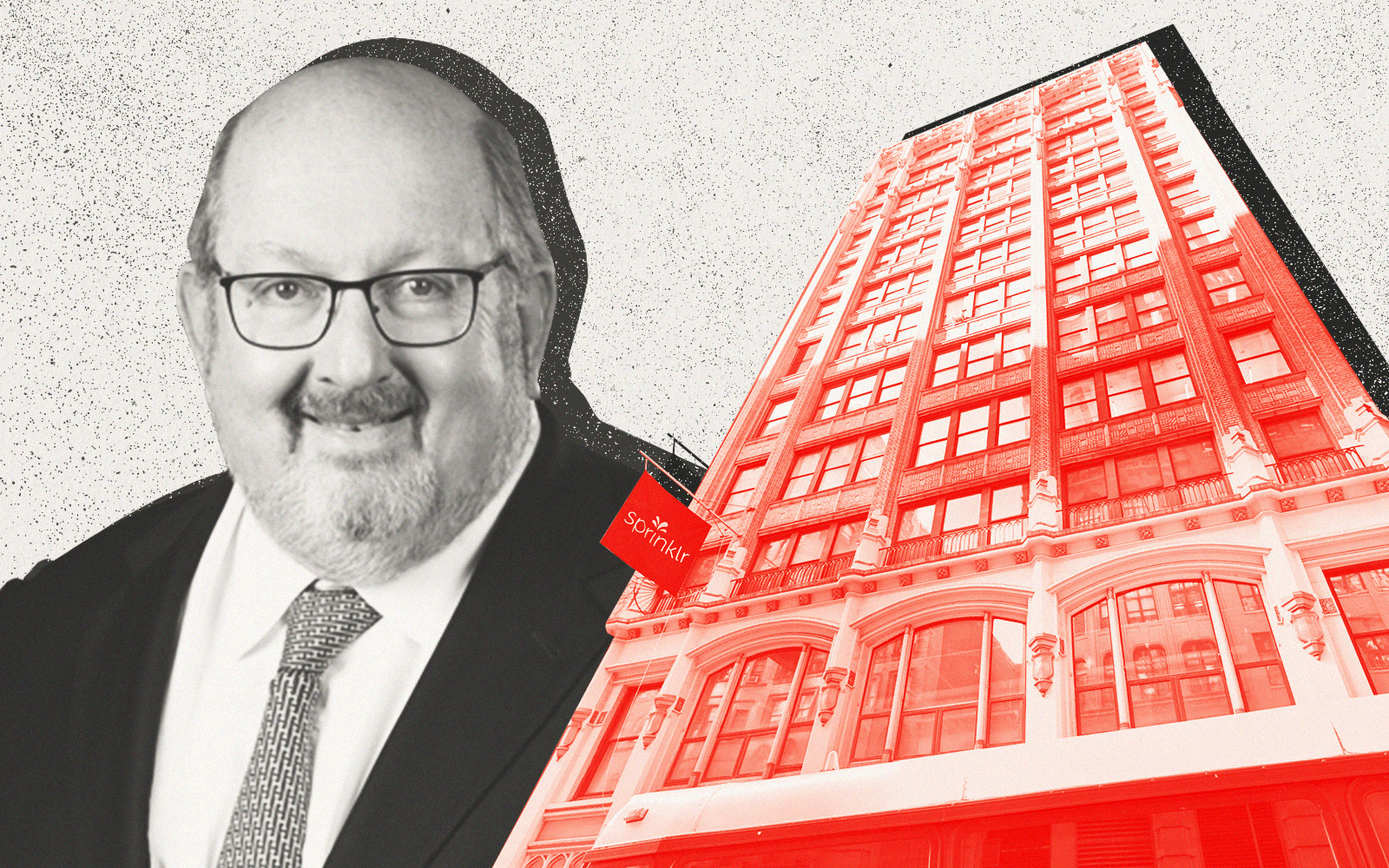

Albert Monasebian and Nader Hakakian launched into workout talks last year after defaulting on the loan backed by 16 East 40th Street, a century-old, nothing-special, 12-story building a block from Bryant Park.

Vacancy had ballooned, net cash flow turned negative and the partners quit making payments on the $32 million loan, Morningstar Credit details. Their special servicer filed to foreclose — what’s often seen as a contingency measure if negotiations go nowhere.

The partners, meanwhile, have charted an escape route — through the sale of the building, last appraised at $61 million.

By Monasebian’s telling, they could soon be in the clear. The principal said he and Hakakian had received a $35 million offer for 16 East 40th Street, a price that would exceed the debt and a deal he expects to close in two months.

The building also received a new appraisal this month — $22 million, according to Morningstar.

The spread shows just how ambiguous office values remain. A sale price would provide a desperately-needed data point to parse what unwanted product is currently worth.

The combination of low deal volume and few foreclosures have made it nearly impossible to gauge if the New York office market has hit bottom. That is, what people will pay for the bargain bin.

But ratings agency appraisals aren’t the ideal barometer. An analysis by The Real Deal found such firms, which include Morningstar, routinely value properties more conservatively than an independent appraiser might.

Monasebian, who contested the $22 million valuation, added that distress can dock value.

“It’s always lower when it’s in workouts,” he said of an appraisal.

Reappraisals are a key component of those negotiations. Special servicers working on behalf of bondholders need to know where values stand, especially given the deterioration of office.

If the deal closes for $35 million it would price the property at $364 per square foot, well below the $615 average Marcus & Millichap tracked through the first quarter, but above the $100-some per square foot that office assets in Los Angeles, which has found bottom, have traded for.

$22 million, by comparison, would workout to $228 per square foot.

16 East 40th Street should sell for a steal. The building — fully-occupied in 2017 — was just 40 percent leased last year. Drew Silvester, a Colliers broker heading leasing for the property, said there were approximately three tenants in the building.

Monasebian, for his part, said his team is negotiating new leases, and stressed that they had recently pumped $4 million into renovations.

But Silvester didn’t note any major improvements. Rather, he said that across the city, Class B Owners face a cash-flow crunch, which is making it harder to invest..

“The competition is kind of eating those guys up,” the broker said.”It’s challenging with that type of product.”

For any firm that does buy 16 East 40th Street, the play would be value-add. LoopNet marketed the property as such in a listing that is no longer active.

In that case, high vacancy would be an asset, allowing for speedier renovations that could attract new tenants and higher rents. It also opens the door to residential conversion, especially if the price is low enough.

If nothing else, the purported offer signals there is still a market for assets that many have written off as in perpetual decline.

As recently as the first quarter, Marcus & Millichap flagged that buyers were showing a “burgeoning demand for local lower-cost offices” in Midtown, noting the rise in “Class B/C trading.”

Read more

Wednesday’s interest rate cut could draw more value-add office buyers out of the woodwork. If financing is cheaper, investors can pay more, perhaps matching the price demands of owners in distress.

Whether those prices are enough to cover loan balances is a different story

“There’s definitely a market for them,” Silvester said of lower-quality office buildings.

“For 50 cents on the dollar,” he added.