Real estate developers face many risks when turning to the cash-for-visas EB-5 program to finance their projects.

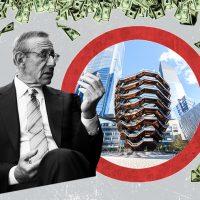

But Related Companies CEO Jeff Blau is facing one he could never have predicted.

Blau alleges seven EB-5 investors in Related’s Hudson Yards development regularly surround his Upper East Side home, directing threats against him and his family, according to a lawsuit Blau filed last week. The investors say they will continue until Related returns their $500,000 investments.

The protests started in January and escalated from banging pots and pans to making threats against Blau’s family, according to Blau.

In April, investors allegedly sent Blau photographs of his children entering the house, claiming that Blau should expect “surprises” and “greetings” until they received their money back.

This summer, one of the demonstrators allegedly told Blau they would send toys to Blau’s young children and sent photographs of a doll and a Lego set.

Blau filed a lawsuit against seven investors in New York Supreme Court late last week. Blau is seeking to obtain an emergency injunction from the court to stop the investors from harassing his family outside their home.

“We hope the court will quickly issue a judgment in this matter and put an end to this misconduct and invasion of privacy,” a spokesperson for Related said in a statement.

When The Real Deal reached out to the defendants named in the complaint, one claimed to be working on a settlement with Related and said she was on the West Coast and hadn’t visited New York City for a long time.

Another said he never demonstrated outside Blau’s home or instructed anyone to do so.

“I also have family and children, and I do not condone such extreme behaviors or language,” the defendant claimed.

Related was among numerous real estate developers in New York City to raise money through EB-5. The federal program allows foreign investors to obtain a green card — permanent resident status — in exchange for an investment of at least $500,000 in a U.S. business.

Many of these investors came from China and the money financed ground-up real estate projects. It became a critical part of a developer’s capital stack because it was cheaper than traditional mezzanine debt or preferred equity.

The program faced a host of issues, including long wait times for visas and fraud by middlemen known as regional centers.

In the case of the Hudson Yards project, Blau alleges that regulations governing EB-5 mandate foreign investors to keep their money “at risk.” Debt arrangements are not allowed.

Blau further alleges in the lawsuit that the investors have received their green cards and no payments to the defendants are overdue. His suit notes that the protesters are not entitled to be paid any sooner than others who invested at the same time.

In June 2017, Related sought to obtain $380 million in EB-5 money to fund a platform over the rail yards and its buildings at 35 and 55 Hudson Yards. The firm had already raised $600 million. The company faced criticism for obtaining the lower minimum investment amount of $500,000 per investor by “gerrymandering” a series of census tracts to a less affluent one in Harlem.

At the onset of the pandemic, Related halted distributions to some EB-5 investors. Related argued it made all required payments and the distributions were optional.

Read more