R&B Realty Group filed for bankruptcy last week on two Midtown office properties it yanked from the brink of foreclosure a few years ago and which are now tangled in a lawsuit.

In May, Lightstone Capital sued R&B for “blatantly misappropriating” about half a million dollars from 28 West 36th Street and 32 West 39th Street, collateral for a $52 million Lightstone loan, court records show.

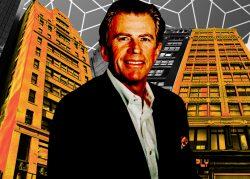

R&B, run by Aron Rosenberg, allegedly defaulted on the senior debt and then failed to deposit rents in a clearing account — a requirement of the loan terms in an event of default. Two months ago, R&B agreed to the appointment of a receiver that would collect past-due rents and profits, the suit alleges.

The bankruptcy filings block Lightstone from collecting on any past-due debts.

R&B’s attorney in the Lightstone legal battle, Kevin Nash, did not return a request for comment. Neither did Lightstone’s lawyer nor R&B’s bankruptcy attorney.

Rosenberg has been in and out of court over the two run-down Garment District buildings for more than three years.

Maverick Real Estate tried to foreclose on the deals in early 2021 after it bought the debt from the now-defunct Signature Bank. Rosenberg protested that Maverick was “charging a default interest of 24 percent on each of the loans, and seems intent to…acquire the buildings on the cheap.”

Maverick is a distressed debt investor; default interest is its bread and butter.

By the skin of his teeth, Rosenberg came out on top, securing a $51 million loan from Ladder Capital. “Very fortunate,” the principal said of the eleventh-hour financing.

A year later, in March 2022, R&B refinanced with Lightstone, which had underwritten one of the buildings, 32 West 39th Street, as a 16-story office condo conversion.

A year after that, Rosenberg’s firm had quit paying debt service.

As of May 2024, when Lightstone filed suit, 32 West 39th was 77 percent vacant, the complaint alleges, signaling the conversion has yet to pull tenants if it’s panned out at all. 28 West 36th Street is just 8 percent vacant.

As part of the Lightstone’s loan terms, R&B was supposed to drop all rents and revenue into a clearing account if it defaulted on the debt. Lightstone alleges it needed assurance its collateral could be maintained given the borrower’s “apparent financial difficulties,” the complaint reads.

Instead, R&B was skimming some off the top, Lightstone claims.

“There was a significant decrease in deposits into the clearing account,” the lender writes.

Lightstone confronted R&B over that alleged “outright theft.” but the borrower was “full of excuses.” It played dumb and blamed tenants for the missing money.

The lender alleged in the May complaint it had shouldered all of the properties’ carrying and maintenance costs since R&B’s default and didn’t know if it could do so much longer.

It’s unclear what, if anything, the receiver appointed in August has collected from the borrowers. The docket for the Lightstone case was last updated two months ago. The case is ongoing.

Read more