A cash-starved Midtown office building went back to its lender last month in a credit bid.

It’s a typical outcome, especially for an asset with little appeal. The lender announces an upset price or how much it will let the asset go for. Assuming no one will top the figure, it opens bidding so low — say $1,000 — that no third party will bid it up. It takes the building, pays minimal transfer tax and ideally, sells it later for more than it would fetch at auction.

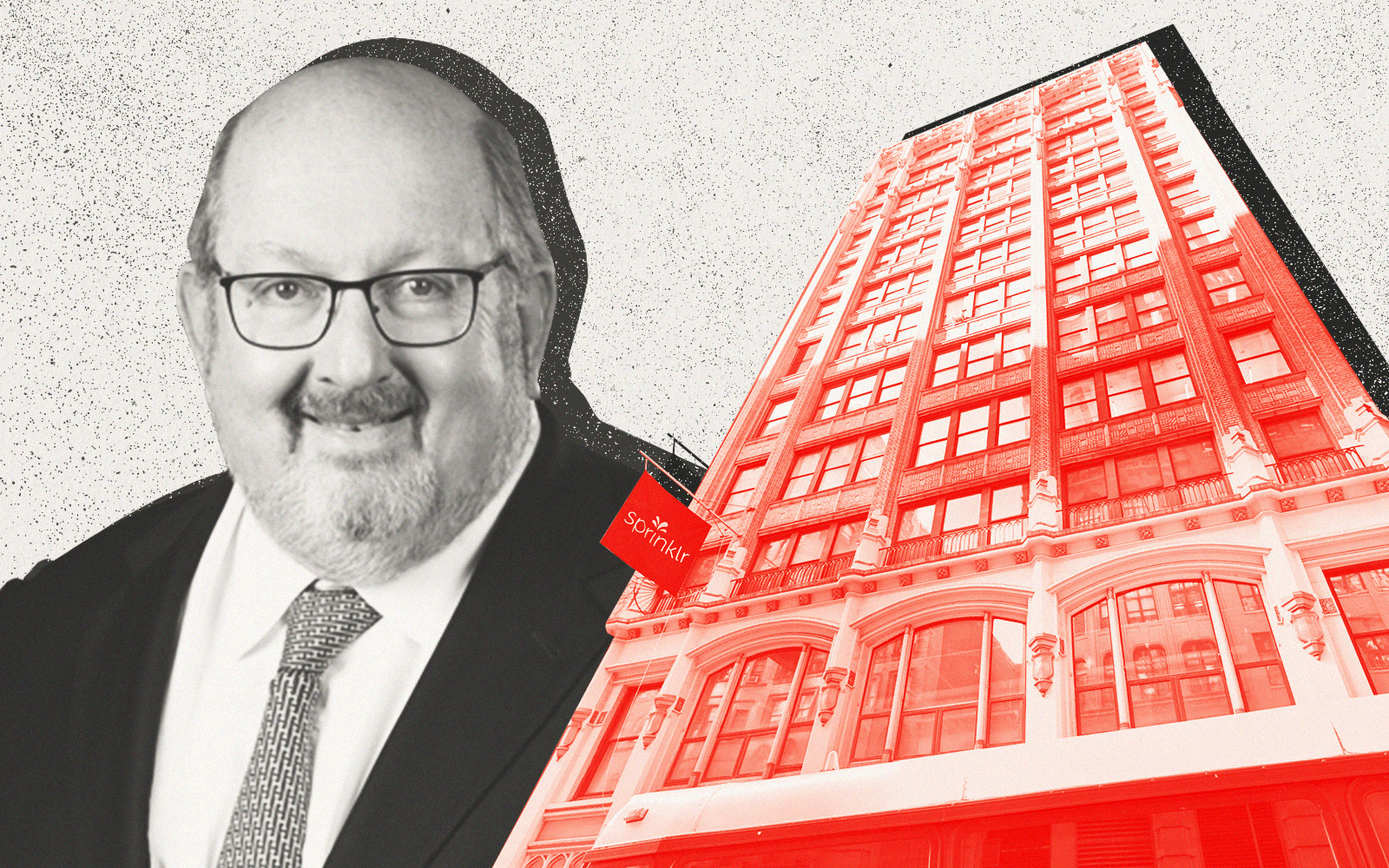

But that’s not what happened with Paul Sohayegh and Roni Movahedian’s 29 West 35th Street.

The bondholders on the $41 million CMBS loan appear to have opened bidding at $23 million, according to court and auction documents. That’s well below the dollar amount that would have made it whole, but high enough to saddle it with an extra $477,000 in transfer taxes.

The move suggests the lender was sending a message to bidders: We’ll let the building go for $23 million, or a 60 percent discount to the $62 million we’re owed — fees, interest and all.

At $23 million, the 85,000-square-foot building would have sold for $270 per square foot, and there were still no takers.

“It’s feasible they could have said: ‘If someone comes up to us with $23 million, we’ll take our money and run,” Matthew Mannion, an auctioneer who was not involved with the 29 West 35th Street auction, said of the high credit bid.

It’s unclear if the plaintiff’s attorney announced $23 million as the upset price or the amount at which it would let the asset go (The upset price can also mean what the figure that will make the lender whole.)

Scott Siller, the referee on the auction, said he couldn’t recall and the figure is not listed in court records. Herrick Feinstein, the law firm representing the lender, declined to comment.

But it’s highly unlikely the bondholders on the CMBS loan would opt to pay more in transfer taxes by opening bidding at $23 million. The transfer tax rate is 1.4 percent for sales of $500,000 or less and jumps to 2.075 percent for sales of $3 million or more.

“The only reason you would do that is if you were willing to entertain some bids far under your upset price,” Mannion said. “Otherwise you’re just paying transfer tax for no reason.”

Read more

A price of $23 million would have been a big haircut, a price that dwarfed the original loan amount and the lender’s $62 million judgment. It also pales to the $30 million Sohayegh and Movahedian paid for the property in 2007 and the $80 million it hoped to fetch 10 years later.

The fact that no one jumped at 29 West 35th Street signals just how undesirable a century-old, half-vacant Midtown office has become.