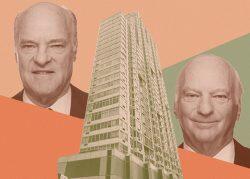

KKR has sold 80 Dekalb, one of Downtown Brooklyn’s first rental towers, to Atlas Capital in one of the borough’s bigger sales this year.

The private equity firm got $202.5 million for the 365-unit rental tower, a source familiar with the transaction said.

KKR declined to comment. A spokesperson for Atlas said the purchase underscores the firm’s continued investment in New York City. JLL brokered the deal for the seller, the source said.

The sale price represents a modest premium to the $190 million a KKR fund paid when it partnered with Dalan Management on the acquisition just two years ago, a small feat considering valuations have slipped on the rise in interest rates.

The deal also shows more signs of life in an investment sales market that went catatonic in 2023, and underscores that institutional capital, after some time on the sidelines, is driving those deals.

“The demand for free market buildings is extensive,” Shimon Shkury of Ariel Property Advisors said over the summer. “We see institutional money after it, we see international money investing in it.”

KKR was most recently on the buy side of that equation. The firm partnered with Dalan Management to snap up 540 Fulton Street, a rental tower around the corner from 80 Dekalb, for $240 million this summer.

That deal was one of two this year to top the 80 Dekalb sale, according to property records and data compiled by PincusCo.

The other was Michael Stern’s transfer of his ownership interest in 9 Dekalb Avenue, the borough’s tallest tower, to Silverstein Capital Partners for $672 million this summer. That trade was driven by a maturity default, another catalyst for deals.

The debt on 80 Dekalb didn’t push KKR to sell. Rather it drew Atlas to the deal, a spokesperson for the buyer said.

KKR had a long-term, fixed-rate, assumable loan — a golden ticket in the current interest rate environment. The private equity firm bought 80 Dekalb with a $132 million mortgage in early July of 2022, only 150 basis points into the Federal Reserve’s 525-point tightening cycle.

As for KKR’s motivations, the source familiar with the deal said the firm was looking to return capital to investors and liked the price point.

Atlas Capital, which focuses on opportunistic and value-add deals, made a splash this summer when it scored a $1 billion loan for a luxury condo project with Zeckendorf Development, what was thought to be Manhattan’s biggest residential construction loan since the pandemic.

The firm already owns The Denizen, a luxury multifamily building in Bushwick the group bought from Yoel Goldman’s troubled All Year Management in 2021 for $506 million.

Read more

This article has been updated with additional information from an Atlas Capital spokesperson.