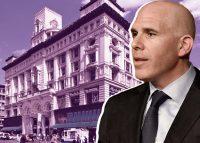

Five years ago, 620 Sixth Avenue was riding high — flush with retail and office tenants and a new, $421 million mortgage.

One pandemic later, it was half empty and worth less than its outstanding debt.

But now Scott Rechler’s RXR and Hudson Bay Capital have forged a joint partnership to acquire and recapitalize the 700,000-square-foot building in what they call a model for rescuing assets slammed by Covid.

RXR, which already owned half of the building (excluding a retail condo owned by 32BJ SEIU), and Hudson Bay Capital secured a five-year, $320 million loan on the Manhattan property, with each side emerging with a 50 percent stake in 500,000 square feet of office and retail space.

The loan, first reported by Commercial Observer, was furnished through a group of lenders including Goldman Sachs and Blackstone, a source told the publication. Property records show the property’s existing debt, three loans totaling $421 million, were consolidated this month.

The numbers suggest that the senior debt of $334 million was repaid in the recap, but not all and perhaps not any of the subordinate debt.

Scott Rechler, CEO of RXR, said in a statement that the deal “demonstrates that by applying capital and capabilities to the right asset with the right capital structure, iconic buildings like 620 Avenue of the Americas can thrive in a post-pandemic world.”

RXR has a long history with the building, which was constructed in 1896. After buying a 55 percent share in a 2011 deal that valued the building at $500 million, the firm bought the remaining 45 percent the next year. RXR then sold a 46 percent stake and most of its equity to Blackstone in 2015.

In the fall of 2019, five months before Covid shut down the city, the owners scored a $421 million financing package including the $334 million senior loan from Goldman Sachs, a $14 million building loan and a $73 million project loan.

In the following years, occupancy dropped. Two tenants that leased more than half of the building’s space, WeWork and Bed Bath and Beyond, declared bankruptcy, which would have allowed them to exit their leases without penalty. Both companies have left the building.

As remote work took hold and tenants abandoned dated offices, Rechler famously put his buildings into one of two categories: “digital” and “film.” He must have put 620 Sixth into the former group, because RXR bought back Blackstone’s 46 percent stake in 2023 and has signed leases for 300,000 square feet there in the past two years.

Retailer Cole Haan renewed an 11-year lease for its 62,000 square feet of offices on the third floor, Commercial Observer reported in September. And building service workers union 32BJ SEIU signed a 20-year agreement to grow by nearly 21,000 square feet on the first floor.

The office portion of the property owned by RXR and HBC is now fully leased. Their retail space is about 70 percent leased, and the owners expect to fill the remaining space in the next seven months.

Read more

The building is on the corner of West 19th Street near Madison Square Park and the residential enclave of Chelsea. A vestige of Manhattan’s Gilded Age, it features large rows of windows and 100,000-square-foot floor plans.

“Given the dislocation in real estate markets, we believe high-quality assets paired with creative capital solutions can drive attractive risk-adjusted returns,” said Sander Gerber, CEO of Hudson Bay Capital, in a statement.

— Caroline Handel