Edward J. Minskoff Equities locked down a loan modification on 1166 Sixth Avenue late last month — a vote of confidence by lender Wells Fargo in the firm’s plan to plug a gaping vacancy.

The bank extended maturity dates and tweaked interest rates on three loans totaling $235 million, according to property records. On the smallest mortgage, an $11.5 million project loan made in 2019, Wells Fargo knocked $10 million off the balance.

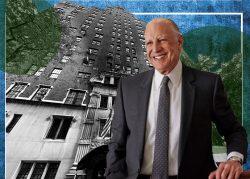

Edward Minskoff, who heads the eponymous firm, declined to comment.

Wells Fargo’s modifications may prove to be a lifeline for EJME.

The securitized debt on 1166 Sixth, a clunky 70s-era Midtown office tower, landed in special servicing this summer as the building’s top tenant headed for the exit. Hedge fund D.E. Shaw had leased two-thirds of the tower, according to Morningstar.

The servicer on the building’s $85 million CMBS debt flagged the loan for imminent maturity default. Revenue, at the time, was covering just 1.3 times the amount needed to cover the monthly mortgage payments. For many lenders, that debt service coverage ratio is too close for comfort.

EJME jumped head first into negotiations, according to servicer commentary, and submitted a workout proposal just a few months later.

Read more

It’s unclear from the loan documents how Wells Fargo altered the interest rates or maturity dates on the loan. EJME was previously paying 5 percent on the CMBS debt, which was set to mature in 2027.

The workout allows EJME more time to find tenants for 1166 Sixth. Minskoff’s firm tapped JLL for leasing and is marketing the building’s seven empty floors as a possible two-story atrium and gallery that would open onto a small park.