A Seattle-based lender has filed a lawsuit against real estate investor Gary Segal, seeking more than $67.1 million for allegedly failing to honor a personal guarantee on a defaulted commercial real estate loan.

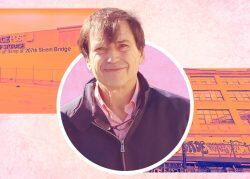

Columbia Pacific Advisors filed the complaint this week in New York Supreme Court, PincusCo reported. The lender claims Segal breached his obligations under a personal guaranty agreement tied to a loan for a Long Island City industrial warehouse, where an office development is planned.

Segal guaranteed a loan made in December 2021 to the entity that owns 23-10 Queens Plaza South, according to the complaint. The original loan amount was $38.5 million, but through several modifications, the principal allegedly increased to $56.9 million by March 2024.

The lawsuit claims Segal failed to repay the loan when it matured in August. Despite receiving a notice of default in October, neither the borrower entity nor Segal has made any payments toward the outstanding debt, which now exceeds $67.1 million including interest and fees, according to the complaint.

Columbia Pacific Advisors is seeking a judgment for the full amount due, plus ongoing default interest, legal fees and other costs outlined in the loan documents.

The lender initiated a separate UCC foreclosure process on the ownership interests in the borrowing entity. An auction is scheduled for May 9.

Columbia Pacific Advisors did not immediately respond to a request for comment from The Real Deal. Segal could not be reached for comment.

Two years ago, the City Council passed a zoning change that would allow Segal’s firm, Dynamic Star, to develop a 400,000-square-foot office building at the site, dubbed Opus Point. Segal purchased the property in 2019 for $27.5 million.

Long Island City is not the only place where Dynamic Star is putting out alleged financial fires. This year, a joint venture of Blackstone and Rialto Capital filed a pre-foreclosure action, alleging Dynamic Star and Namdar Realty Group defaulted on a loan for the Fordham Landing site in the Bronx.

The lender is seeking a receiver to oversee the site while pursuing a forced sale.

Read more