The Moinians and the Katzes have spent 15 years quarreling over an apartment building in the Financial District, a dispute likened to one of American folklore’s most infamous family feuds.

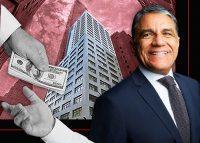

Now, Joe Moinian and his brother are on the verge of losing 90 Washington Street, a 1970s-era brick office building that they took over in the wake of 9/11 via a hundred-million-dollar ground lease and converted into 396 apartments.

Gary Katz’s family, which owns the ground under the building and leases the property to the Moinians, argued they failed to properly fix safety issues with the brick facade and violated their lease.

In the years they’ve been squabbling over the facade, a neighboring developer built and completely sold out a condo tower nearly twice the size of 90 Washington right next door — a foil to the futility of their disagreements.

“The core issue is the inability of the parties, plaintiff and defendant — The Moinians and the Katzes; sounds like the Hatfields and the McCoys with a Jewish hint. . . to arrive at a mutually agreed to path to complete the façade renovations,” Edward Klein, an attorney for Moinian, said at a trial in June. “Both sides have tried, but they haven’t succeeded.”

Katz, however, told a judge that there’s no personal enmity between him and Moinian.

“We actually have a very fine personal relationship outside of a significant business conflict,” he said.

Following a nine-day trial last year, a court found Moinian violated his ground lease. Last month, a judge appointed a receiver to take over the property and prepare it for a foreclosure sale.

The Katzes

Gary is the son of Daniel P. Katz, a parking-lot executive who in the 1960s and ‘70s bought up unwanted properties in Manhattan.

“My dad had no capital or ability to borrow when he started building his parking business and had his lots mostly on month-to-month leases, so he would offer to demolish existing buildings in exchange for a longer-term lease to operate the site as a parking lot,” Gary explained in an interview with the website FoPro.

Gary, who invests through his White Plains-based family office Downtown Capital Partners, said that his father didn’t have the cash to put money down on properties, so he would rely on seller financing.

But Daniel’s main business was operating parking lots, and when he died of suicide in 1987 at the age 48, there were no set plans in place to run the more than 30 buildings he had accumulated. When the recession hit in the early 1980s, the Katzes — Gary, his mother, Rosalie and his two sisters, Meredith and Wendy — had to sell most of their properties at rock-bottom prices.

One property they kept was 90 Washington Street, which was developed into a 27-story office building in 1970 and served as the back offices for Bank of New York Mellon. In the aftermath of 9/11, the building was empty and the Katzes were looking for someone to help them find a solution.

Enter: The Moinians

Joe Moinian, meanwhile, had started converting old office buildings into apartments in 1998 with the 221-unit 100 John Street, which is just a few blocks west of 90 Washington.

As he became more active in FiDi, he and his brother David acquired the long-term ground lease on 90 Washington in 2003 and spent two years converting it into apartments at a cost of $135 million — about $30 million of which the brothers funded themselves.

This is where things start to get complicated.

In 2003, he negotiated an amendment to the lease; Moinian testified that he negotiated this change with Gary’s mother, but Rosalie Katz had been diagnosed with terminal cancer the year before, and the Katzes’ attorneys insisted Gary was at the table.

Recognizing the costly expenses of converting and maintaining the building, Katz offered Moinian a below-market price on the ground lease. In exchange, he negotiated conditions that his attorney said were completely unprecedented: They required that any major capital improvements Moinian made to the property be done in a “workmanlike manner with materials of the same class and quality as the original,” and specified that the developer provide the Katzes with plans from an architect approved by the family.

The Dispute

Those conditions would start coming into play in 2010 when the Department of Buildings issued a notice saying that 90 Washington was unsafe and in violation of Local Law 11 due to cracked and shifting bricks in the facade.

Moinian came up with a plan to fix the problem, but instead of replacing the damaged masonry and joints, he opted to clad the building with 1,200 aluminum panels.

But the project dragged on as work started and stopped.

In the more than 14 years that Moinian worked on the facade, Francis Greenburger’s Time Equities developed an entire 64-story condo building from the ground up next door at 50 West Street.

“Moinian could have built eight to ten Empire State Buildings in the time this facade has taken,” said Joshua Bernstein, an attorney for the Katzes at Akerman.

Katz accused Moinian of cutting corners and doing slipshod work, trying to milk the building for profits.

One of the issues may have been the developer’s financing. Moinian used low-cost Liberty Bonds available for downtown development projects after 9/11 and tapped the state’s 421g program, which reduced taxes for conversions for a period of 12 years.

In the early years, the building had financed lots of cash and was hugely profitable. But after 15 years, the debt payments on the Liberty Bonds began amortizing, and other expenses began to rise.

“As time went on, the annual net rental payments increased, the tax abatements and other exemptions expired and the payments related to the Liberty Bonds increased, leaving plaintiff in a more cash-neutral position, at best,” Katz wrote in an affidavit.

In August 2018, Katz notified Moinian that his work on the facade violated the terms of the ground lease and sent a 30-day notice to cure before he planned to terminate the lease. The two sides extended the cure period 19 times but eventually hit a wall. On the day before the final extension was set to expire, Moinian went to the court to obtain a Yellowstone injunction preventing his landlord from terminating the lease while he tried to cure the violation.

Moinian’s attorneys said that Katz’s real motivation behind the litigation was that he was unsatisfied with the sweetheart deal he had agreed to.

“Landlord’s concession in the affidavit of its principal, Gary Katz, that the rents it is currently receiving are substantially below market, shows the landlord’s true motivation in serving the notice to cure, which is to harass tenant and to wrongfully force tenant out of its valuable leasehold,” they wrote in court filings.

As a lengthy and costly legal battle loomed, Moinian agreed to open up about 200 panels on the building and allow engineers to inspect the work underneath. But opening the panels damages them and they usually are thrown away and replaced, Moinian said. So he stopped.

“I thought that opening the panels, there’s no good reason to do that anymore,” he testified at trial. “It made absolutely no economic sense.”

Manhattan supreme court judge Nicholas Moyne cited that testimony in September when he ruled that Moinian had breached the lease agreement for failing to get Katz’s approval for the project and fixing the safety violations.

(It also didn’t help Moinian’s case that he submitted an affidavit to the court in July 2021 that the work was complete but later admitted in June that the project still wasn’t finished.)

Moyne wrote in his ruling that Moinian made a business decision to not correct the work on the upper part of the building.

“It is entirely possible that had [the engineer’s] original design plan for the panel project been allowed to come to fruition, the building’s facade would be considered safe by now,” he wrote. “However, the tenant did not allow this, thus the lease was breached.”

Breaching the lease put Moinian in default on his mortgage, and in February, Fannie Mae — which holds the $75 million in Liberty Bonds he used on the project — filed to foreclose. A federal judge on March 21 appointed a receiver to take over the building and hire a broker to market it for sale.

Read more