The Federal Savings Bank of Chicago has sued Paul Manafort and his wife, Kathleen, and is seeking to foreclose on the former Trump campaign chairman’s Hamptons mansion.

The bank claims that Manafort has defaulted on a $9.5 million loan for the Water Mill, New York, home. The couple started mortgage payments on Jan. 1, 2016, but have made no payments on the 174 Jobs Lane home loan since Nov. 1, 2017, and owe more than $9.27 million as of March 2, Bloomberg News reported.

Read more

The lawsuit was filed Tuesday in federal court in Brooklyn.

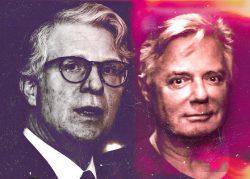

In 2019 federal prosecutors charged founder of the Federal Savings Bank Stephen Calk with bribery, claiming that he pushed through $16 million in “high-risk” loans despite red flags, while seeking a position in the Trump administration. Though Manafort wasn’t named in court papers in the case, the description of the official who received the loans matches him, according to Bloomberg.

The Hamptons loan was rejected by the bank in October 2016, but after Trump was elected president the following month, Calk prompted the bank to go back and approve it.

Manafort was charged in 2017, convicted in 2018 and sentenced to seven and a half years in prison in 2019. Manhattan District Attorney Cyrus Vance brought state charges against Manafort that same year, alleging that Manafort had faked business records to obtain loans, but a court forced Vance to drop the case, citing double jeopardy.

President Donald Trump then pardoned Manafort in December 2020.

[Bloomberg] — Sasha Jones