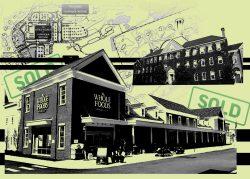

Cortlandt Crossing is changing hands.

The ShopRite-anchored shopping center in Westchester County is being sold by the original developer to Invesco Real Estate for $65.5 million, according to the Westchester & Fairfield County Business Journals.

Cortland Crossing Owner LLC, an entity of Invesco, agreed to purchase the Mohegan Lake shopping center from Acadia Cortland Crossing LLC, an entity of Acadia Realty Trust, the publication reported.

According to CBRE, Cortlandt Crossing is 95 percent leased, anchored by the supermarket and a HomeSense retail location. Other tenants include Chipotle, Verizon and an urgent care center. It is about 40 miles north of New York City.

Located on Route 6, the shopping center includes a gross leasable area of about 128,000 square feet. More than 22,000 cars drive down Route 6 on a daily basis, according to CBRE.

Read more

CBRE represented Acadia in the sale and procured Invesco as the buyer, according to WestFair Online.

“We continue to see incredible demand for retail centers like Cortlandt Crossing, which provide secure, long-term cash flow and a highly attractive rent roll,” said CBRE’s David Gavin, who was part of the team that arranged the sale.

Shopping centers have as a whole fared better than malls in recent years.

Acadia spent more than $60 million developing the shopping center, which was completed in 2018.

Acadia is still in the retail game in New York City, where it co-owns the City Point development in Downtown Brooklyn with Washington Square Partners. Irish retailer Primark recently signed a 70,000-square-foot lease at the complex, joining other tenants including Target, Alamo Drafthouse and Trader Joe’s.

At the end of 2021, Invesco teamed up with Fairstead in paying more than $350 million for an affordable housing portfolio of 48 Bronx buildings spanning 2.3 million square feet across nearly 2,000 apartments. Property Resources was the seller.

Cortlandt Crossing is not the only Westchester County shopping center to be sold in recent weeks. In January, the retail portion of the Chappaqua Crossing development was sold for $79.5 million by a joint venture of Summit Development and the Grossman Companies. The buyer was an investment management firm.

[WestFair] — Holden Walter-Warner