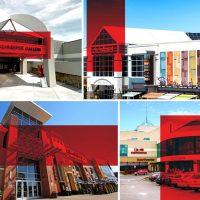

Everything at the Poughkeepsie Galleria is 71 percent off — but shoppers shouldn’t get too excited.

The value of Pyramid Management Group’s property at 2001 South Road had dropped by a staggering 71 percent since the 2011 issuance of two commercial mortgage-backed loans secured by the mall, the Commercial Observer reported. CRED iQ appraisal data show the mall was valued at $68 million as of mid-March.

The 1.2 million-square-foot regional mall is collateral for two CMBS deals totaling $131.5 million. When UBS arranged the CMBS transaction, however, the mall was appraised at $237 million.

Anchor stores like Sears and JCPenney closed their locations in 2020 as part of nationwide store consolidation efforts. Other major retail tenants, including Macy’s, Target and Best Buy, remain open, but the mall’s overall outlook is uncertain.

Pyramid did not comment to the Observer on the valuation decline.

The property’s decline in value highlights the significant challenges faced by older malls, including high vacancy rates and the power of e-commerce.

Syracuse-based Pyramid is also facing financial difficulties with its Destiny USA super regional mall in its home city.

The CMBS loans supporting the initial 1.2 million-square-foot property and its 872,000-square-foot expansion saw appraisal reductions totaling more than $242 million as of November 2020, according to Trepp. Pyramid secured a five-year extension with Wells Fargo on $430 million of CMBS loans for the regional mall; the loans were originally set to mature last June.

A $245 million CMBS loan collateralized by the majority of Pyramid’s Crossgates Mall in Albany was sent to special servicing in February due to imminent maturity default. In March, Fitch downgraded the debt, citing declining performance and concerns regarding Pyramid’s ability to refinance.

A loan on the same mall also went into special servicing in April 2020, one of four Pyramid loans to cross that bridge that spring. Loans secured by Destiny USA and the Poughkeepsie Galleria were among those sent to special servicing a month after the pandemic first roiled brick-and-mortar retail.

— Holden Walter-Warner

Read more