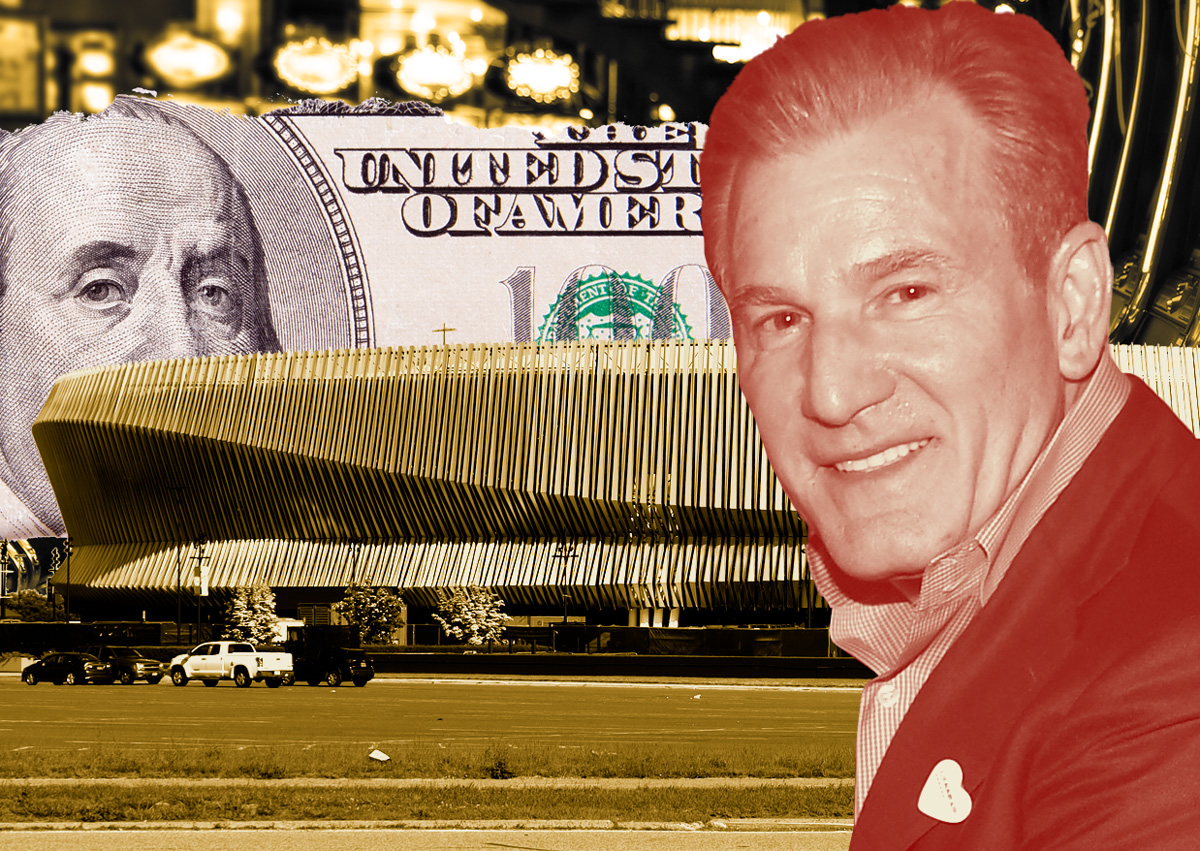

Nick Mastroianni II may not have revived Long Island’s aging Nassau Coliseum, but he still earned a hefty payday for the property.

Las Vegas Sands paid Mastroianni’s LLC $241 million to acquire the Coliseum’s lease, Newsday reported. The disclosure was made in a quarterly report Sands filed with the U.S. Securities and Exchange Commission.

For reasons not clear, the payment included $92 million said to be a “goodwill” premium, meaning a surplus on the property’s actual value.

Mastroianni sold his ground lease to the Sands back in June, but no price was publicized at the time. Sands negotiated a new 99-year lease with the county, where political support was near-unanimous, though community support — especially from nearby universities — is more divided.

When the lease sale closed, Mastroianni said he made a profit on the deal, likely a relief considering the bath he could have taken.

Mastroianni envisioned a $1.5 billion redevelopment of the site through a partnership with Scott Rechler’s RXR, master developer of the site. Mastroianni started primarily as a lender, accumulating $100 million in EB-5 money — essentially funds raised from investors seeking U.S. residency — to renovate the Coliseum.

Covid all but shut down the venue, though, and keeping the lights on became a challenge. It didn’t help that then Gov. Andrew Cuomo pushed for a new arena at nearby Belmont and EB-5 funding dried up.

Sands is planning a $4 billion project at the Coliseum, where a casino would be the centerpiece, as long as the company wins one of the three downstate licenses that are yet to be awarded by the state.

The company is seeking tax breaks for its development of the 72-acre Nassau Hub. The gaming giant has said it would develop the site even if it doesn’t get the one casino license believed to actually be in play; the company is required to build a luxury hotel, entertainment center and a housing component under the lease terms and is also considering conference space, a health club and restaurants.

— Holden Walter-Warner

Read more