The site of San Jose’s main flea market, which has environmental and zoning approvals for more than 3,400 new homes and 3 million square feet of offices, is on the market for about $300 million.

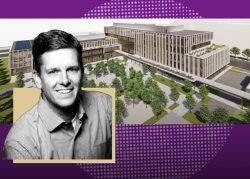

The 63-acre property at 1590 Berryessa Road is mainly surface parking for the market, which covers less than a fourth of its acreage. It and the 57 acres immediately north of it make up the site of Market Park San Jose, a $3 billion project consisting of a retail center, single-family homes, condos and apartments, public parks and offices.

A pair of homebuilders and Borelli Investment have completed 1,000 housing units and a 101,000-square-foot retail center anchored by a Safeway, CVS, Chase Bank and Carbon Health on the project site’s northern half. The slightly larger southern parcel is zoned to accommodate three times as many homes and 3.4 million square feet of offices for tech or life science companies. Construction work can’t begin there until the city approves development applications with building designs for each of the project’s different phases, a process that typically takes more than a year to complete for each phase.

Still, the flea market site is Silicon Valley’s largest mixed-use development site near transit, according to its offering memorandum. It’s directly adjacent to the Berryessa BART station and one of the last remaining opportunities to build significant “scale on rail” in the Bay Area. And whether all its planned housing and offices are built will determine the success of the entire Market Park project, which has homes, shops and restaurants but not the job centers needed to make it a dense transit village.

“This is the largest parcel available on the BART system that’s entitled and available under one ownership,” Borelli Investment’s Ralph Borelli said in an interview this week. “It’s a very unique opportunity in the entire Bay Area.”

Borelli is working with commercial real estate firm Newmark to market what they’re calling the “South Village” on behalf of the Bumb family, which owns the 120-acre Market Park site. The firm softly marketed the flea market parcel at the end of last year and formally launched sales efforts in early February, Borelli said. While it’s available for sale unpriced, Borelli has told interested parties that its pricing guidance is $300 million, he said.

Interest has been “very strong” from commercial and residential developers and from some owner-users, Borelli said. He and Newmark, which is leading marketing efforts, have received two letters of intent to acquire the property from companies Borelli declined to name. One of them values it at more than $300 million and is looking at redeveloping the flea market site by itself.

They expect to have a better sense of its market value by next quarter after more interested parties respond to their request for proposals, Borelli said.

Meanwhile, he and land-use consultant Erik Schoennauer are working on processing a planned development permit and a vesting tentative map for the South Village, which would allow the property to be subdivided, pending city approval. Splitting the site into chunks would enable the Bumbs to sell it to multiple developers, even though it’d be simpler to deal with one entity, Borelli said.

He and Schoennauer are also working on obtaining financing for the $100 million in new infrastructure tied to the property’s redevelopment. The pair, the city of San Jose and a nonprofit affordable homebuilder are teaming up to apply for an infill infrastructure grant, Borelli said. The Market Park team is also looking to form facilities and financing districts to raise additional funds.

Newmark expects a single master developer to acquire the South Village because that would give it control “over a larger vision,” the firm’s Steven Golubchik wrote in an email. A Newmark team of Golubchik, Scott Bales, Nicholas Bicardo and Ramsey Daya are acting as exclusive investment and financing advisors for the property.

Read more