A temporary hotel is coming to a high-end apartment project in downtown San Jose, giving the property owner a chance to collect income from a portion of its units for at least a year while it leases up the development.

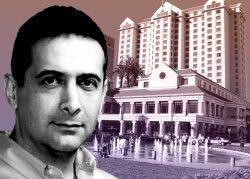

The pop-up hotel by Placemakr, its first in California, will open next month in Miro, a two-building, 630-unit apartment project at the northeast corner of Fourth and Santa Clara streets, across from San Jose City Hall. The 105-room hotel operation — about 15 percent of Miro’s unit count — will take up the seventh through 13th floors of the project’s “West Tower,” Matt Conti of Bayview Development Group, the owner and developer of the apartment complex, told The Real Deal.

Hotel guests won’t be able to access the other building, an “East Tower” that is now half full, Conti said.

Hotel rooms will be available starting May 13, according to Placemakr’s website. Single-night stays during that week range from $234 for studio suites, which can accommodate two people, to $336 for two-bed, two-bath suites with room for four, assuming a guest takes advantage of a 15 percent promotional discount off the best available rate.

A month-long stay at the hotel would cost roughly between $6,000 and $9,100, depending on what type of room they book, according to Placemakr’s website.

An apartment at Miro costs between about $2,800 a month for a studio to about $6,100 a month for the priciest two-bed, two-bath suites, according to its website.

San Jose-based Bayview expects the apartment-hotel hybrid at Miro to be a win-win-win scenario for it, Placemakr and the City of San Jose, which will collect revenue from a 10 percent transient occupancy tax levied on its guests. For Bayview, it’s getting another source of income from apartment units that would have otherwise sat empty as it seeks to fill Miro’s half-vacant East Tower before opening the other building to prospective renters.

The vision behind Miro, which the developer completed in August, was to create a project in downtown San Jose that couldn’t be found elsewhere in its residential market, with sweeping views of the Diablo and Santa Cruz mountains and upscale amenities such as a private dog park and co-working lounges. The project’s lease-up to date shows that demand for such units exists, Conti said.

Placemakr’s hotel concept puts Bayview in a familiar position — introducing something to San Jose that isn’t there now — yet “all indicators point us to believe, once again, the demand” is there, he said.

San Jose’s hotel industry, like most others across the U.S., has struggled during the pandemic. The city last year said that hotel tax revenue wouldn’t return to pre-pandemic levels until 2025. The $1.4 million it collected in such taxes in January 2021 was less than 30 percent of what it took in a year prior, which has had a “devastating” impact on its operating budget, according to San Jose Spotlight.

There are reasons for optimism, though. An 805-room hotel half a mile away from Miro is slated to reopen under the Signia by Hilton brand next week, and the city’s downtown convention center drew thousands of visitors for a video game tournament earlier this month. Because Placemakr’s Miro hotel is offering stays as short as one night to up to one year, it, in theory, can attract a larger pool of customers compared with the Signia by Hilton or other hotels in the area.

“We take on a lot of people who are doing home relocations, and we’re close to San Jose State University, so it could be professors who are coming in and are there for only three or four months,” Placemakr’s Vuong said. “A lot of companies have gone to work-from-home models, but they may need employees to come in for weeks at a time or to work on special projects. We can handle those longer-term stays.”

Bayview expects Placemakr’s San Jose hotel to be open for at least a year and a half, and likely longer, Conti said. The firm wants to get Miro’s 326-unit East Tower “pretty well leased” before making the West Tower available for rent, he said. If all goes to plan, Placemakr will start slowly winding down its operations in a couple of years, at which point both towers will have reached stabilized occupancy.

Placemakr’s pop-up hotels, which is how it made its name after launching in 2016, now make up 20 percent of its business, according to the Washington Business Journal. The rest comes from its so-called hospitality living properties, entire apartment buildings that the company permanently manages and are available on a short, medium or long-term basis, the publication said.

After laying off a “significant” number of employees during the pandemic, Placemakr is in expansion mode. It’s raised $127 million to date and has partnered with three investment managers to make $1 billion in property acquisitions within the next two years. All U.S. markets are in play for the company’s next expansion, CEO Jason Fudin told the Business Journal last month.

Read more