A 1920s-era apartment building with postcard views of Alamo Square listed recently for $20 million, the highest asking price for a multifamily property on the market in San Francisco.

With 30 studios and 12 one-bedrooms in just over 30,000 square feet, 625 Scott Street is also the largest apartment building for sale in the city, just edging out a 36-unit Nob Hill apartment building with 29,610 square feet that is asking just under $17 million.

It may be the highest-priced multi family in the city but it’s not the most expensive per square foot or per unit, said listing agent Allison Chapleau of Vanguard Properties, who is co-listing the property with Brad Lagomarsino of Colliers International.

“I actually think we’re really well priced,” she said, adding that she is expecting offers from both family offices and institutional investor groups on Friday.

The building has been in the hands of a private ownership group called the Delta Group for about four decades, she said, though the group’s members changed about ten years ago when some owners bought out others. Some members own other multifamily properties in the city but this is the only one owned by this particular set of investors. As they approach retirement age, they’re “looking to spend less time managing assets and more time enjoying the fruits of their labor,” Chapleau said.

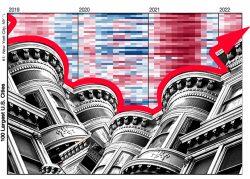

The sale could offer a test of the San Francisco apartment market, which is still lagging behind the rest of the country in terms of rental recovery since the pandemic pushed the vacancy rate up and rents down in the second half of 2020 and first half of 2021. Demand was up considerably by last summer, especially from younger tenants looking to trade up during the downturn, and rents are now just below their pre-pandemic rates.

Chapleau said that the discounts seen on other apartment buildings recently reflected a higher percentage of vacancies in those properties. The Scott Street property has only one vacancy, she said, and has been able to bring in tenants throughout the pandemic.

Just under half the units in the Scott Street property turned over during the downturn and, under the city’s strict rent control laws, new tenants have now locked in rents at a few-hundred dollars below the $2,650 market rent for studios and $3,375 for one-bedrooms in the building, according to Chapleau’s data. Several more have long-term tenants paying even less— one tenant from 1979 pays $740, and another who has been in a top-floor, south-facing apartment with cityscape views since 1984 is at $1,000 a month. There’s also a resident manager, mandatory for all buildings over 15 units in California, who lives rent-free. The gross rental income is just over $1.2 million, though the building could be bringing in about $300,000 more if all tenants were paying market rents, according to Chapleau’s figures.

The 1928 property has seen roughly $500,000 in major capital improvements over the last few years, including new windows, improved waterproofing, and upgraded fire alarms and fire escapes, Chapleau said. An elevator upgrade took place in 2018. Most of the units are renovated, she said, and even the studios are about 800 square feet, with hardwood floors and big windows to let in light. The central location near the bustling Divisadero corridor, hip Hayes Valley and famed “Painted Ladies” has remained popular throughout the pandemic, she added.

“It’s the definition of a trophy building,” she said. “Could it be any more trophy?”

Read more