UPDATED: MARCH 6 at 2:15 p.m.:

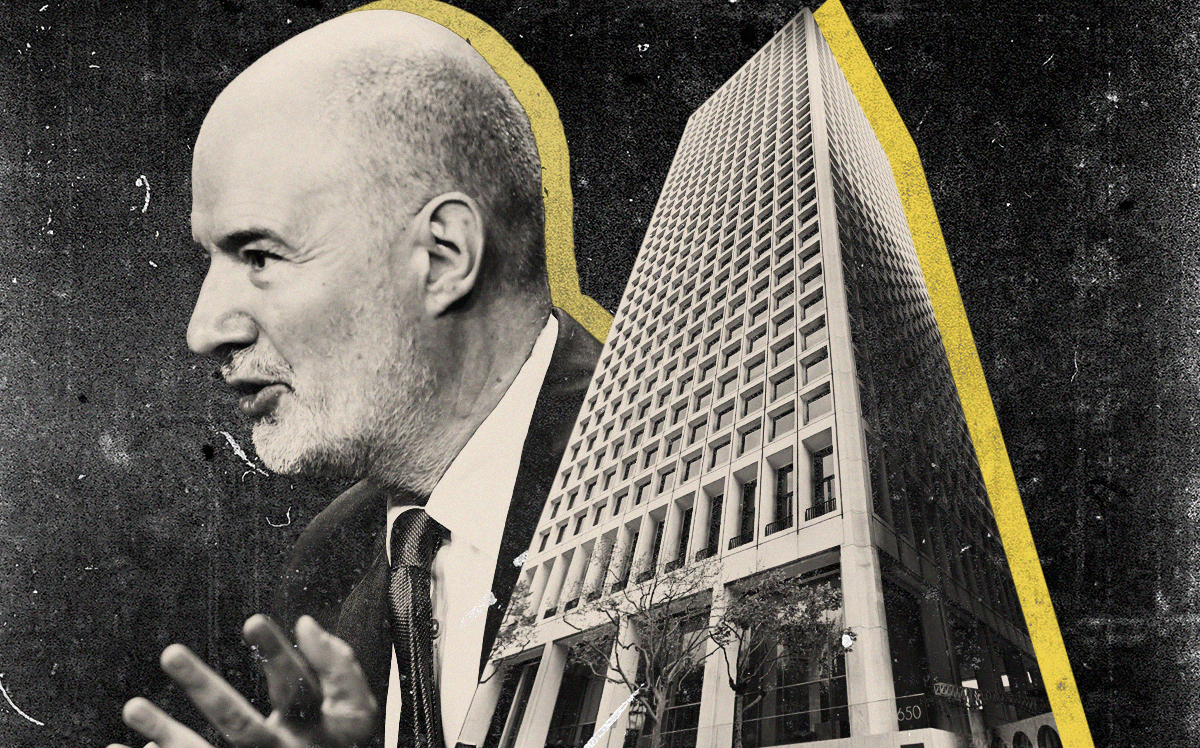

The Apartment Investment and Management Company, or Aimco, has found a buyer willing to pay $167.5 million for what had been a $275 million mezzanine loan on ParkMerced, San Francisco’s largest multifamily community.

The 152-acre apartment complex next to San Francisco State University is owned by Maximus Real Estate Partners, which has been working towards a large-scale redevelopment of the 1950s-era property for over a decade. Yet even after a nearly $1.8-billion recapitalization in 2019, when Barclays and Citi financed a $1.5-billion senior loan, construction has not yet begun.

Maximus asked for forbearance in the early days of the pandemic, but the senior loan held by Aimco is now performing. It is, however, on a servicer watch list because its cash flow only amounts to about 40 percent of the benchmark debt service coverage ratio. Another issue putting the project on the watch list is the complex of more than 3,000 apartments and townhomes was only 70 percent occupied in the second quarter of 2022, according to notes from the loan servicer. The analysis cited anything below 80 percent occupancy as a concern.

“Given the decline in the underlying collateral value, Aimco recorded a non-cash impairment charge to reduce the value of the mezzanine investment to $158.6 million,” in the fourth quarter of 2022, according to a report Aimco, a Denver-based multifamily lender, released last week.

Aimco has now entered into an agreement to sell the mezzanine loan for $167.5 million, though the closing “is subject to a reasonable due diligence period and certain approvals and, as such, is not guaranteed,” the report reads. Eastdil Secured brokered the loan sale. The buyer was not disclosed and Aimco did not immediately reply to a request for comment.

“What their actions say is we’ll never do better than getting $167 million for this today,” said Trepp’s Manus Clancy, adding that it’s possible Aimco believes the investment will regain value in time, but doesn’t want to wait it out.

Clancy said even with the loss it is “encouraging” that Aimco was able to find a buyer at all, given how difficult it has been to sell or refinance CMBS loans on office properties.

“There’s a buyer. There’s a seller. There’s an agreed-upon price,” he said. “That’s evidence of a market functioning.”

If the sale closes, Aimco expects to use a “swaption,” basically insurance to protect against future interest rate increases, purchased at the origination of the loan to bring the total gross proceeds of the transaction to around $220 million. The report did not say whether the extra value would come from the buyer or the secondary market, but, if accurate, that would make the sale a 25 percent loss instead of 40 percent.

“For people that bought insurance really cheaply two or three years ago, that insurance is phenomenally valuable right now,” Clancy said.

According to sources familiar with the Aimco loan deal, a swaption was not part of the sale

In the investor report, Aimco said that it had an overall target in 2023 “to reduce capital allocated to alternative investments” and expects to use the proceeds from the sale on “other accretive uses of capital including share repurchases, reducing leverage and investing in its pipeline.”

Moving forward, it is only targeting real estate investment in three markets, according to the report — Southeast Florida, the Washington D.C. metro area and the Front Range area near its Colorado headquarters — and plans to exit the California market completely over time. It has already eliminated its satellite offices and reduced its regional offices to only its three target markets, the report said.

The mezzanine loan was part of an overall $1.8-billion recapitalization that was supposed to kick off phase one of ParkMerced’s long-awaited redevelopment. That phase was expected to create about 2,000 new apartments, according to a Maximus press release announcing the loans. The fully developed property is expected to demolish the existing towers and townhomes, built for soldiers returning from World War II, and create nearly 10,000 new homes, 230,000 square feet of retail, 80,000 square feet of office, 64,000 square feet of amenity space and a new elementary school.

ParkMerced spokesperson PJ Johston declined to comment on the sale of the loan or when construction could begin. A recent story in SFGate details the many construction delays since the property was entitled in 2011, as well as some of the reasons behind them, including the city’s extensive planning and permitting process, lawsuits from environmental groups and the developer’s agreement to replace every rent-controlled unit that would be demolished under the plan. Johnston told SFGate that the project was “ambitious but also very powerful and attainable.”

Addition: Previous story did not include the name of the broker on the loan sale.

Read more