A $400 million loan secured by Shorenstein Properties’ Market Square, best known as the Twitter Building, was paid off in time to meet its early 2023 extension, according to loan documents.

Servicer notes on the loan do not indicate how it was repaid, but they state that bondholders received payment by the Jan. 9 deadline. It may be the rare instance this year of CMBS investors getting their money back in full as the office market suffers one default after the next.

In emails to investors obtained by TRD, special servicer Wells Fargo said that Wells and Barclays had worked on a $500 million refinance before the loan’s initial September deadline. But it is unclear if the refinance went through, as no new loan on the building has yet been recorded.

Shorenstein Properties, Barclays and Wells Fargo all declined to comment on how the loan was paid off or if it was refinanced.

Notably, the emails on the refinance are from August and September, one month before Elon Musk bought Twitter. Soon after, he began laying off 75 percent of the company’s workforce and giving up offices in a building where the social media company holds three-quarters of the space. Some of its leases don’t expire until 2028.

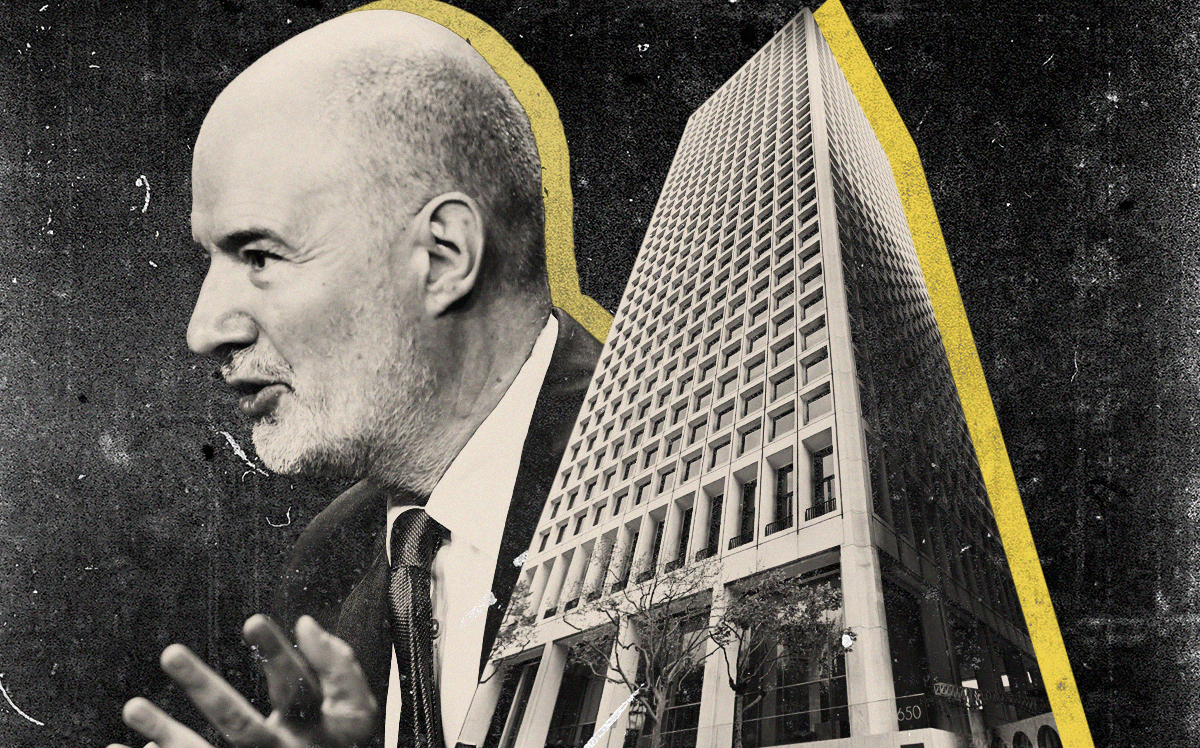

Shorenstein bought the Art Deco high-rise and mid-century mid-rise buildings that make up Market Square for $110 million in 2011 and spent approximately $300 million turning what had been the Western Furniture Exchange and Merchandise Mart into Twitter’s headquarters. Shorenstein sold 98 percent of its interest to JP Morgan for $900 million in 2015, shortly before opening the interest-only loan with Barclays.

But circumstances have changed significantly since the loan originated. The six floors that Twitter’s headquarters used to take up in Market Square have been condensed to two and the social media platform is now being sued by Shorenstein, among other landlords, for nonpayment of rent. More generally, the office market in San Francisco has reached its highest vacancy rate ever, and lending on office properties is at a near standstill. Interest rates are also well above the 4 percent that Shorenstein got on the interest-only loan back in 2015.

Columbia Property Trust recently defaulted on $1.7 billion in office loans, including two where Twitter is a tenant: 650 California Street in San Francisco and 245 West 17th Street in Manhattan. The other San Francisco building impacted as part of the Columbia default is 201 California, which has about 270,000 square feet over 17 floors.

Given all the drama surrounding Twitter and its new owner, as well as the generally dour sentiment in the office market, a senior CMBS analyst called Shorenstein’s one-time payoff “amazing,” even more so if it was the result of a successful refinance.

“I would have thought that this loan would’ve been un-refinacable,” the person commented.

Read more