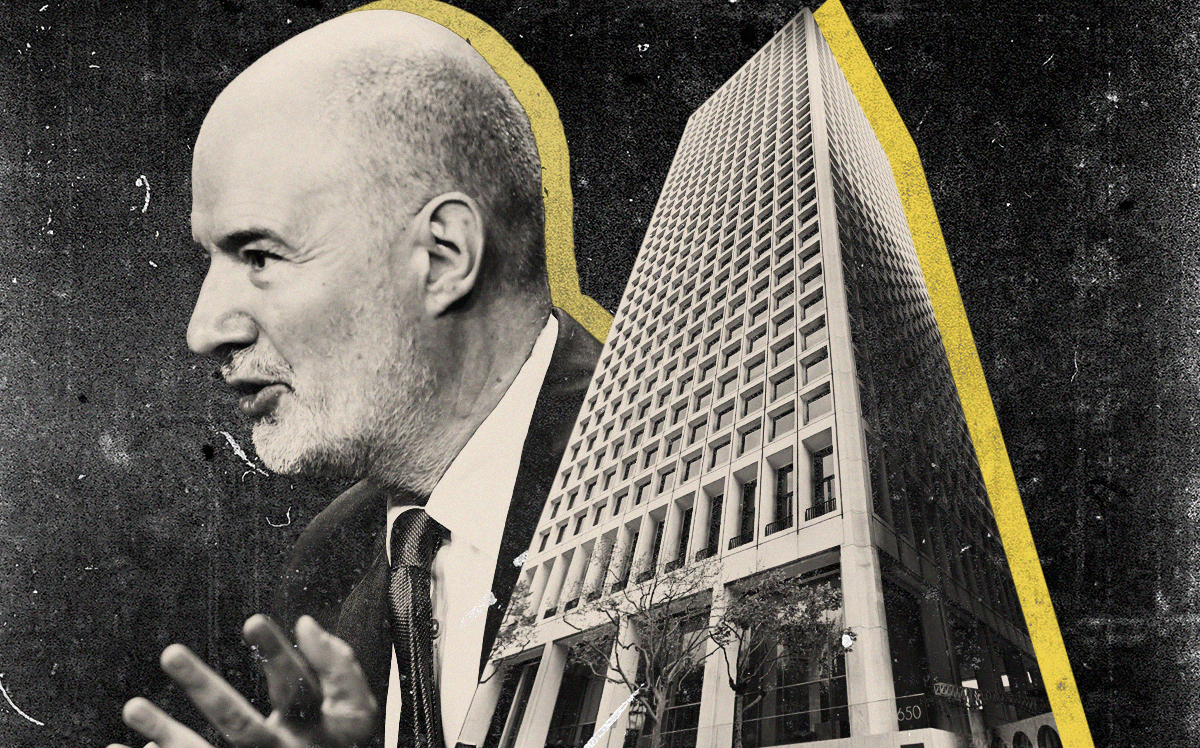

Pollock Financial Group, which owes $30.3 million on a four-story office building in San Francisco’s South of Market, will soon hand its keys to the lender.

The Portola Valley-based investor has declared imminent monetary default and will surrender the 62,300-square-foot building at 340 Bryant Street, the San Francisco Business Times reported, citing disclosures to bond investors.

UBS AG, based in Switzerland, originated two interest-only commercial mortgage-backed securities loans totaling $30.7 million in 2017.

The current balance is $30.3 million, according to a CMBS report last month, and the loans have been delinquent for more than 90 days.

The loans were sent last year to a special servicer, a step often aimed at working out a deal between the lender and borrower. But that didn’t stop Pollack Financial from declaring the monetary default on the Class B building, according to the CMBS report.

The building, now 23 percent occupied, is valued at $53.6 million, according to PropertyShark. It was built in 1932 and is surrounded by onramps to the eastbound Bay Bridge.

WeWork once leased space at the site but moved out and didn’t pay rent for all of 2021, according to the report to bondholders. Logitech occupies 14,597 square feet with a lease set to expire in April.

The pandemic and move to remote work by tech and other firms has pushed office vacancy in San Francisco to nearly 28 percent, according to CBRE, which has put the city on a national watchlist for “the most empty downtown in America.”

Yet the market has not seen many major foreclosures, according to the Business Times, which cited market observers saying lenders would rather work out deals with borrowers — to either extend or restructure loans — than take back the buildings.

Pollack Financial, founded in 1960 in the wealthy town south of Stanford University, offers financial, estate planning and other services. t did not respond to a request for comment from the Business Times.

— Dana Bartholomew

Read more