The former owner of Silicon Valley Bank has gained approval from a bankruptcy court judge to spend up to $100 million over the next month as it tries to sell the bank holding company’s assets.

Judge Martin Glenn of the U.S. Bankruptcy Court Southern District of New York approved the spending by Santa Clara-based SVB Financial Group and suggested it might take years to settle a fight over tangled assets, the San Francisco Business Times reported.

The 40-year-old bank, which had $10.9 billion in real estate loans, was put into receivership on March 10, becoming the second largest bank failure in the nation.

Glenn called for parties involved in the case to cooperate in the interest of maximizing the value of what is left of SVB Financial.

That includes creditors whose lawyers said at a Tuesday hearing that they are concerned that the FDIC will try to hold onto billions of dollars they say they are owed.

“You all have a shared interest in making sure that the debtor’s case proceeds smoothly and information is available,” Glenn said after hearing from lawyers for SVB Financial, the Federal Deposit Insurance Corp., the bridge bank set up by the FDIC and creditors for both the holding company and the bank.

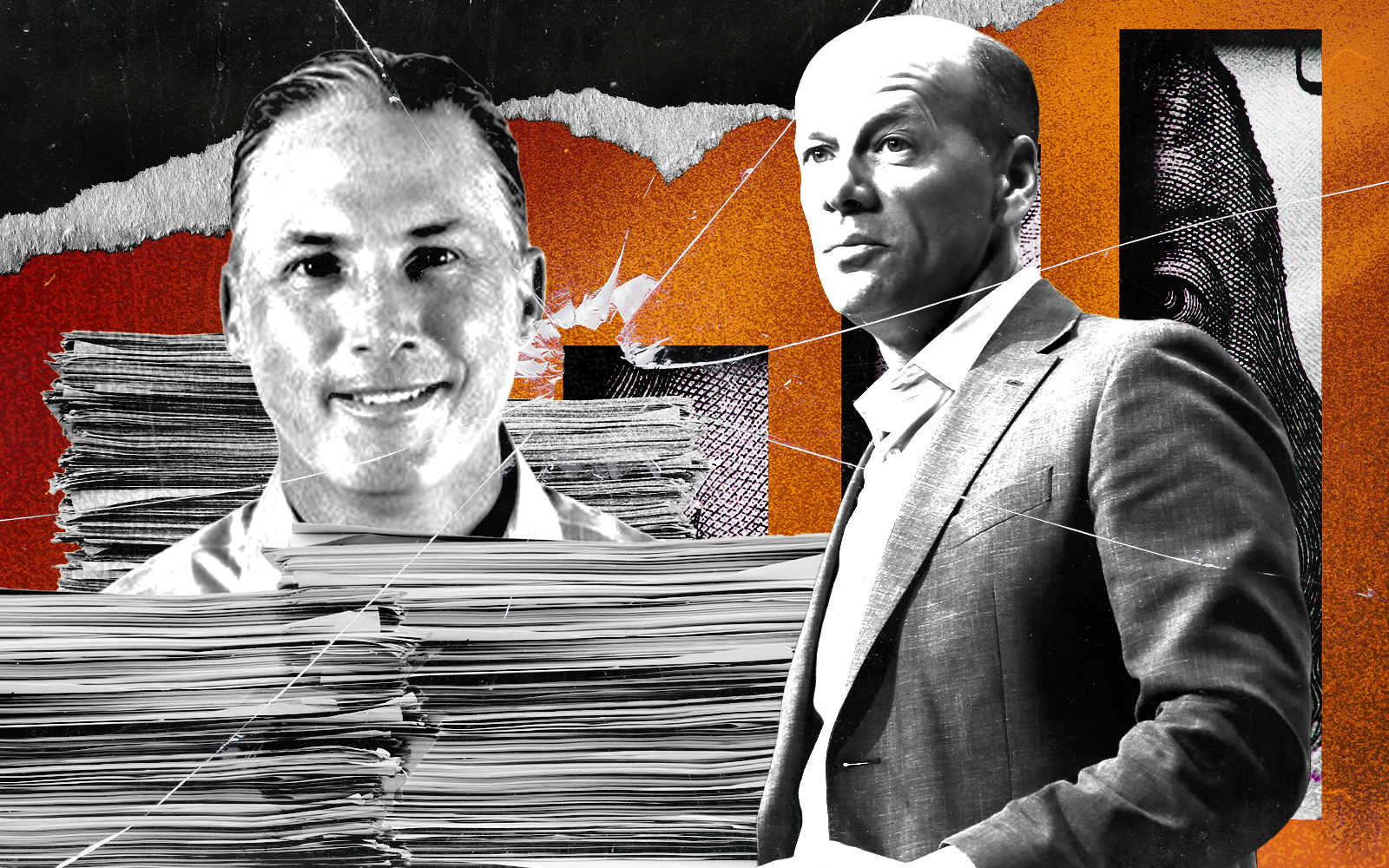

James Bromley, an attorney with Sullivan & Cromwell representing SVB Financial, said that the FDIC improperly froze access to nearly $2 billion in deposits the holding company had in its former bank.

He said the agency had also directed Silicon Valley Bridge Bank, as it’s now called, to claw back nearly $200 million in deposits SVB Financial had at other banks.

That prompted the judge to seek assurances from attorneys representing the FDIC and Silicon Valley Bridge Bank that they:

- Won’t continue to try to recover any funds pending further ruling by the court.

- Would agree to allow SVB Financial to spend the funds it has with the other banks.

- Would agree to continue to pay employees of the holding company who are technically still employees of the bank.

- And would agree to continue to pay the vendors of the holding company

The attorneys largely agreed to the judge’s requests, though a lawyer representing the FDIC, Kurt Gwynne of Reed Smith, said the agency’s position might change.

SVB Financial filed for Chapter 11 bankruptcy protection on Friday while it seeks to sell the businesses that weren’t seized by the government. This includes Menlo Park-based venture unit SVB Capital and Boston-based investment bank SVB Securities, which the holding company said, however, are not part of the bankruptcy proceeding.

The FDIC is separately seeking buyers for the assets of the bank it seized, according to the Business Times.

Its first two attempts failed to land a single buyer for the bank so now it has agreed to take offers for part of it. Bids for Silicon Valley Bridge Bank are due by Friday. Bids for its wealth management subsidiary, Silicon Valley Private Bank, are due by Wednesday.

— Dana Bartholomew

Read more