Redco Development and AEW Capital Management have walked away from San Francisco’s historic First National Bank building after failing to make their mortgage payments.

The San Francisco-based Redco and Boston-based AEW Capital have filed a deed-in-lieu of foreclosure for 1 Montgomery Street, the San Francisco Business Times reported.

They flipped the keys of the vacant building to lender Square Mile Capital, now known as Affinius Capital, based in San Antonio.

Redco and AEW bought the 100,000-square-foot office building in 2019 for $84 million. The price for the 115-year-old landmark came out to $840 per square foot.

It’s among the first office properties in San Francisco to be turned over to lenders in the post-pandemic era, with office vacancy now at 27.6 percent, according to CBRE. Rents have fallen 15 percent, according to JLL.

Across the Bay, Oakland’s office vacancy rate has hit 29.3 percent.

“The combination of lack of tenants, doubling of interest rates and decline in value is lethal,” Ken Rosen, chair of the Fisher Center for Real Estate and Urban Economics at UC Berkeley and head of the Rosen Consulting Group, told the Business Times

Rosen said Class B and C buildings will be hit hardest, estimating that as many as half of the older building stock in the Bay Area’s urban office markets could be subject to restructurings or defaults.

Declining values will make getting new loans difficult, just like it would be for a homeowner who owes more than the home is worth.

“If someone has a loan on a building like that, they won’t have the income to cover the loan and they won’t have the value to get a refinancing,” Rosen said.

The value decline is pronounced in tech-dominated San Francisco, where companies once paid top dollar for feature-rich workplaces designed to keep employees engaged and productive for long hours, according to John Drachman, co-founder of Southern California-based Watershed Property and an adjunct professor in the USC real estate department.

Previous loans were structured for full buildings with high rents.

“Unfortunately, many owners own office assets under financial structures that basically anticipate a world that doesn’t exist anymore — a world where everyone goes into the office five days a week,” Drachman said. “The amount of loss that office buildings in San Francisco specifically will feel will far exceed the tech bubble of 2001 and the great financial crisis.”

Notices of default — which signal a lender’s ability to commence foreclosure — have been filed in the city over the past year, mostly from smaller hotels, small office properties and apartment complexes.

They include the Civic Center Inn at 790 Ellis Street in the Tenderloin and Hotel 964 in SoMa; the 24-unit condo complex at 603 Tennessee in Dogpatch; and the nearly century-old, six-story office building at 88 First Street.

Yotel San Francisco at 1095 Market Street in Mid-Market was acquired for $62 million in a foreclosure auction in October.

This month, the owner of a 62,300-square foot office building at 340 Bryant Street in South of Market requested that its lender take over.

In Oakland, the 120,000-square-foot Plaza 360 owned by Brickman Real Estate at 360 22nd Street went back to its lenders, sources familiar with the city’s office market told the Business Times.

Higher-end buildings in prime locations also face trouble.

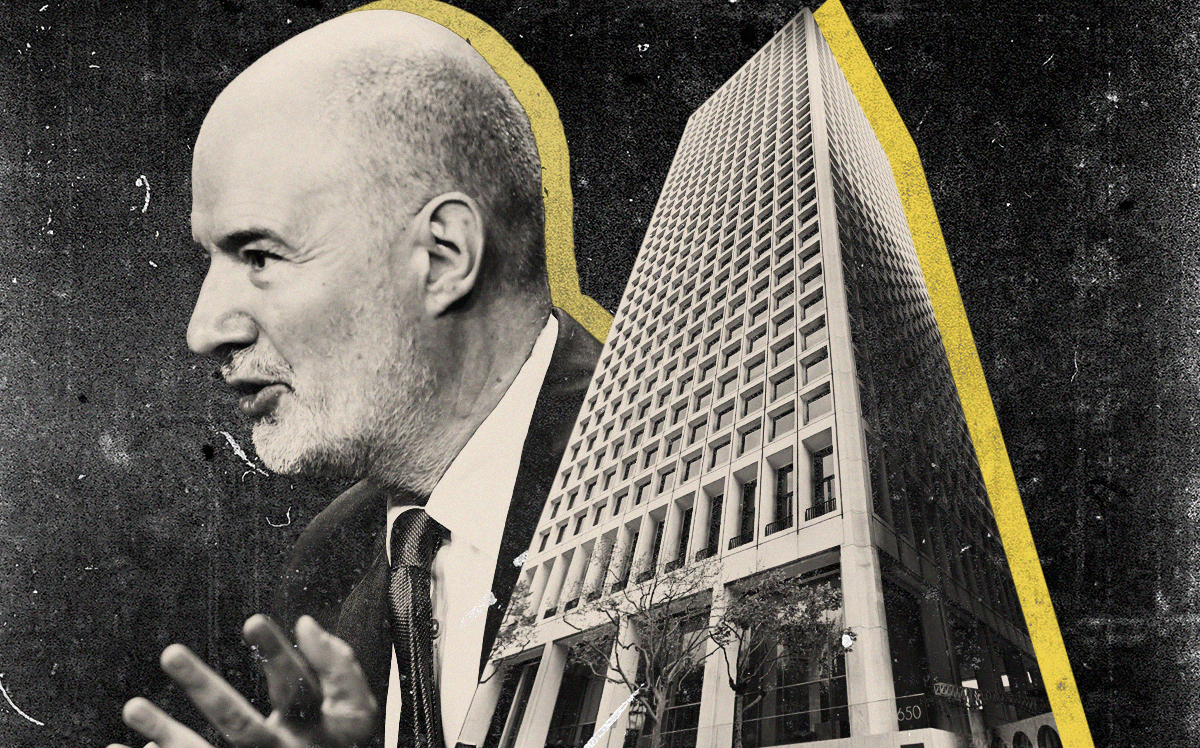

Last month, New York-based Columbia Property Trust defaulted on a $1.7 billion loan backed by a seven-building portfolio, including two office properties in San Francisco: the 470,000-square-foot 650 California Street and the 260,000-square-foot 201 California Street.

— Dana Bartholomew

Read more