The redevelopment site for a 170-key hotel in San Jose has fallen into default stemming from delinquency on the loan. The parcel is set to be sold at auction, according to public records.

The proposed hotel development is at 2850 Stevens Creek Boulevard and is managed by Adeel Mahmood, a principal executive with Villa Developers & Investment. The development firm defaulted on a $6.7 million loan that it obtained from First Credit Bank in 2019. The asset has an unpaid balance of $8 million and the property sale is scheduled for April 12, according to property records.

Mahmood’s group first fell into delinquency on the loan in 2021. It ended up squaring the payments and saved the property from going into foreclosure. It was then put up for sale along with the adjacent parcel at 2812 Stevens Creek in a package deal for $20 million.

Approved plans for the site call for an 11-story hotel with 170 rooms. There is currently a gas station at the location. Property records don’t indicate that the parcel at 2815 Stevens Creek is part of the default or the pending sale of the hotel site.

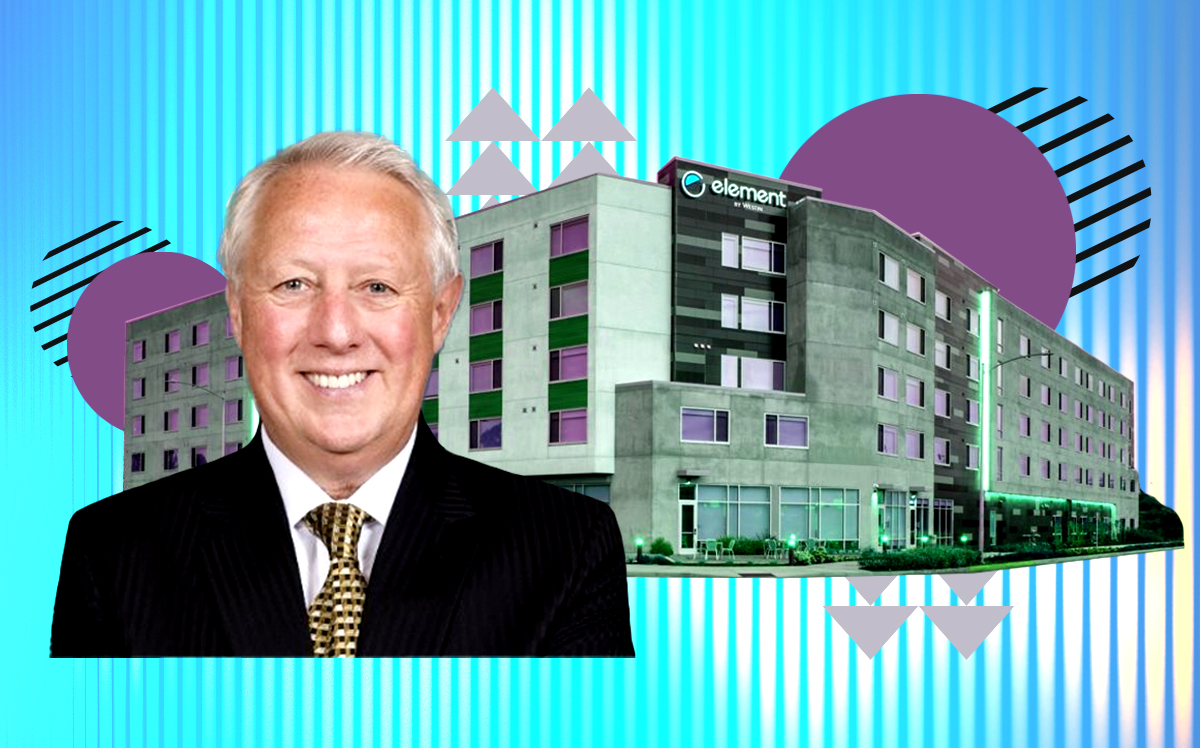

The pandemic rocked Silicon Valley’s hospitality industry with business travel suspensions and projects put on hold. That changed last year, with seven hotels opening in Santa Clara County as halted projects were completed.

“Santa Clara County openings were all business-related hotels that were planned and in construction prior to the downturn in business travel,” Alan Reay, president of consulting firm Atlas Hospitality, said. “These hotels were all planned during the ‘boom’ times for business in Santa Clara County, predominantly driven by tech.”

Recently the Bay Area has experienced the impact of a distressed market with a number of defaults on a variety of commercial properties. Two other San Jose hotels fell into default after failing to pay their mortgages at the end of last year. More recently, Veritas defaulted on its $450 million loan for 62 apartment buildings.

“All property sectors across commercial real estate with maturing loans are going to face some level of refinance stress because interest rates have shot up so quickly in such a short amount of time,” Melissa Che from Fitch Ratings said.

Read more