Office vacancy in San Francisco has shot up to nearly 33 percent, a record, with the rate of empty offices in Silicon Valley 9 points behind.

The proportion of empty offices in San Francisco hit a “new all-time high” of 32.7 percent in the first quarter, up from 32.1 percent from late last year, the San Jose Mercury News reported, citing a report from Savills.

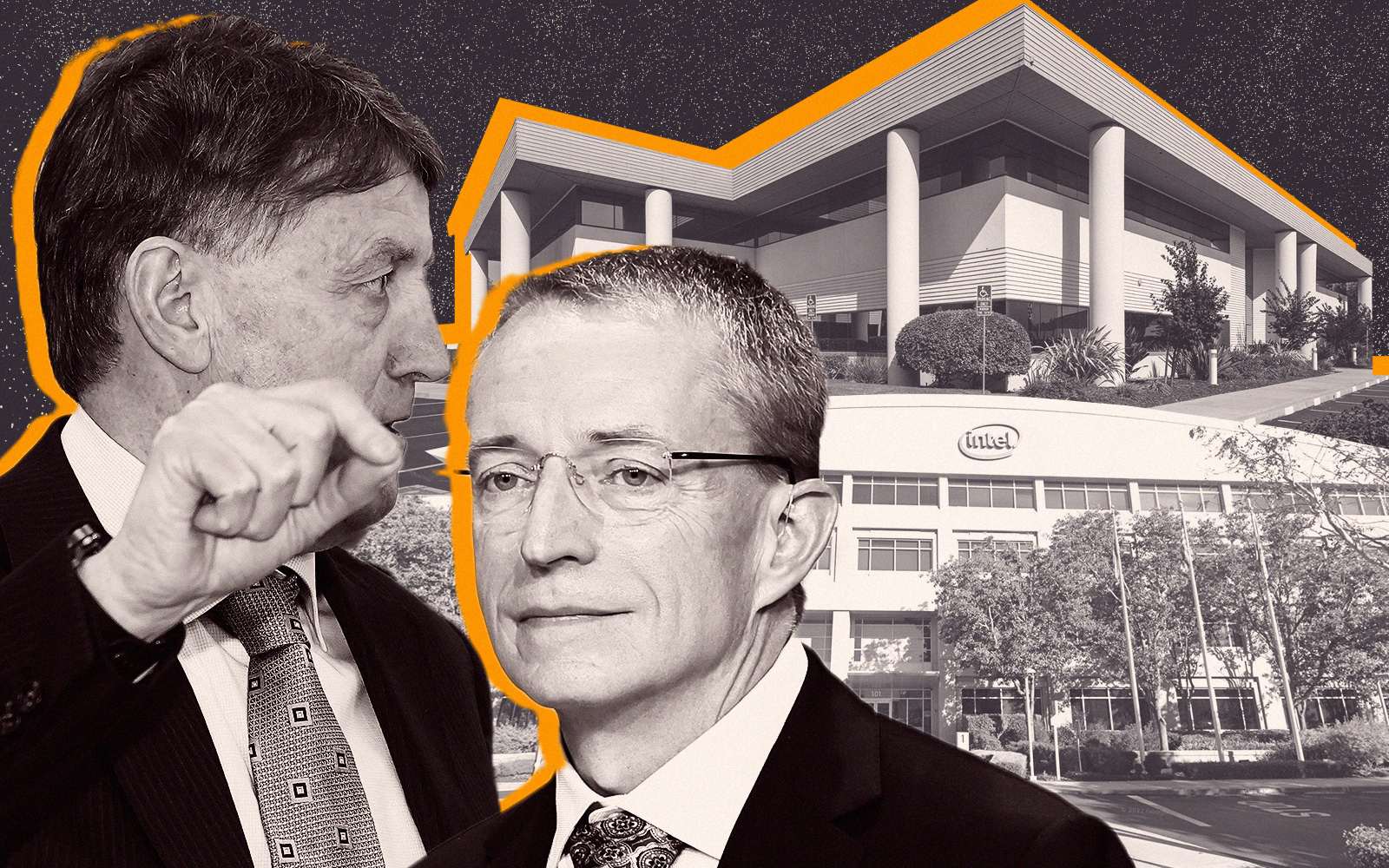

Silicon Valley’s office vacancy rate jumped to a “new historical high” of 23.1 percent during the same period, up from 22.7 percent.

The increased office vacancy rates in San Francisco and the South Bay follow an era of remote work and come amid a wobbly economy jolted by job cuts in the tech and biotech sectors.

Both regions face grim prospects for the rest of the year, according to Savills, a commercial real estate firm based in London.

“With economic uncertainty, slow return-to-office utilization and an ongoing correction in the technology sector, it is no surprise that the San Francisco office market has gone from having the lowest availability levels in the country pre-pandemic to having the highest availability levels in just over three years,” Savills said in its report.

Office rents in San Francisco averaged $5.89 per square foot from January through March, down from $5.94 per square foot from October through December last year.

“We expect office availability (in San Francisco) to continue to increase in 2023 as the slowdown in the technology sector persists,” Savills said.

Office rents in Silicon Valley averaged $4.99 a square foot during the same period, up from $4.95 a square foot late last year.

“Office space demand (in Silicon Valley) has been down significantly as the technology sector continues to undergo a serious correction with mass layoffs and a general freeze in office leasing,” Savills reported.

Soaring office vacancies in San Francisco mean that loans for big office buildings could tumble into default. Worse, they could turn into foreclosures and property seizures.

“With worsening underlying market fundamentals and looming loan maturities, expect more (San Francisco) office property distress to occur in 2023 as many owners find themselves underwater,” Savills said. A commercial real estate property is considered “underwater” if its total loan debt exceeds the value of the building.

In Silicon Valley, tech firms have scaled back plans to rent or build new office complexes and in some cases are trying to sublease or sell their office properties.

“The Silicon Valley office market continues to see record-high availability levels as occupiers have pulled back amid the correction in the technology sector,” Savills said, adding the region should “expect another slow year” in the office sector.

— Dana Bartholomew

Read more