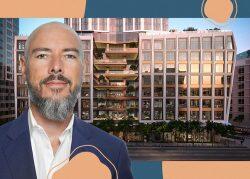

Lendlease has resumed building a 47-story condominium tower in San Francisco’s Hub, the only skyscraper to break ground during the pandemic.

The Australia-based developer, whose construction of the 540-foot tower was put on hold over concerns it could harm rail tunnels near 30 Van Ness Avenue, agreed to comply with certain conditions, the San Francisco Business Times reported.

The $1.15 billion project, dubbed Hayes Point, began last summer and represents the largest Lendlease investment in the U.S. The firm was ordered to halt work in late February.

The hiccup in construction came after the public agency Bay Area Rapid Transit demanded Lendlease submit analysis to demonstrate the project would not adversely impact the Van Ness Muni station and the rail tunnel next door.

BART issued a letter to the city last month recommending preliminary approval of the project’s construction.

To proceed, Lendlease must adhere to several conditions to avoid damaging rail infrastructure. They include handing in a structural evaluation analysis to BART this month now under way by Magnusson Klemencic Associates and Brierley Associates.

Should the report reveal potential harm to the transit system, BART could rescind its approval and require Lendlease to mitigate negative impacts.

BART said it is “supportive” of the Hayes Point project and doesn’t want to hold up progress.

When completed, Hayes Point will contain 333 condos – 83 of them affordable – on the top 38 stories, plus 290,000 square feet of offices and ground-floor shops and restaurants underneath.

Phoebe Cheng, group manager of engineering services at BART, said its concerns about Hayes Point are “typical” for any large project constructed near its infrastructure.

Read more

Cheng said that an initial evaluation showed that there would be no negative impacts on the BART tunnel and Muni station during the site’s excavation. Lendlease must now prove the building will be seismically and structurally sound once complete.

In 2017, Lendlease bought the city-owned 30 Van Ness site for $70 million in cash. The Board of Supervisors had rejected a bid from Related California because its affordable housing commitment was too low.

— Dana Bartholomew