San Jose saw its office market come to a near halt in the first quarter of 2023, according to data provided by Colliers. While the office market experienced the sharpest decline, it isn’t the only sector struggling in the Bay Area city.

Total sales volume for all sectors totaled $235 million in the first quarter, down 68.5 percent year-over-year and 72 percent quarter-over-quarter. Total square footage sold totaled more than 500,000 square feet in Q1 2023, down 85 percent from Q4 2022 and 71 percent from Q1 2022.

There were 38,500 square feet of office sales totaling $14 million in the first quarter of 2023. Sales volume was down 91 percent quarter-over-quarter and 87.5 percent year-over-year. This marks a 97.5-percent decline quarter-over-quarter and 87 percent year-over-over.

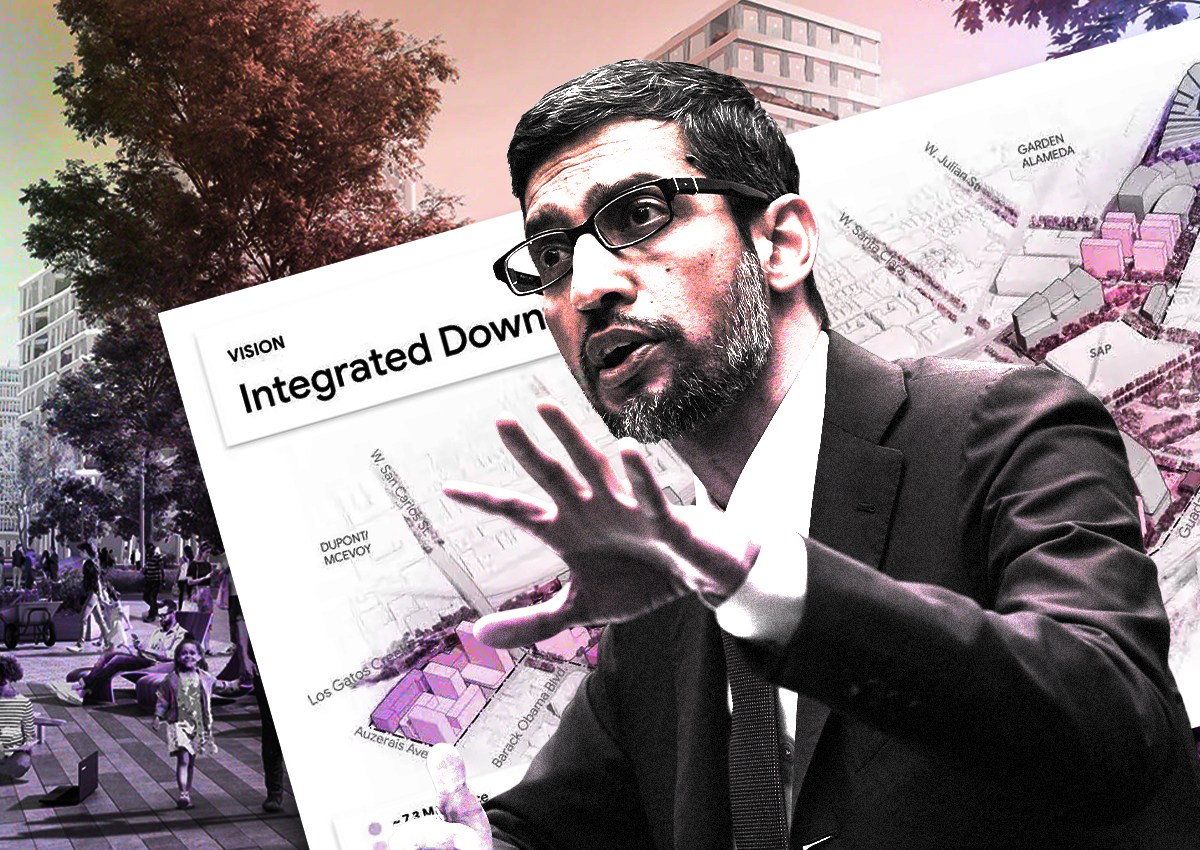

The most chilling example of the office market slowdown was Google’s decision to cancel its “Downtown West” project that would have brought millions of square feet of office to downtown San Jose.

The catalyst of a sluggish return to the office is clear.

“Like all major cities, downtown San Jose continues to struggle to get employees back in the office,” Craig Petersen, an office and R&D specialist at Kidder Mathews, said. “Remote work has persisted longer than most of us thought possible. Companies are starting to demand some return to the office, but it is a slow process.”

Hospitality was the only bright spot in the report, which saw a 74.6 percent increase in total square footage sold and a 141 percent increase in sales volume during the first quarter of this year. This could be attributed to a market correction from business travel finally starting to pick up in Silicon Valley.

Multifamily square footage sold was down 81.5 percent and sales volume was down 85 percent, during the first quarter. And during the same period, industrial didn’t fare much better and was down 69 percent in square footage sold and 82 percent in sales volume. Meanwhile, retail saw a 53-percent dip in square footage sold, but experienced a 16 percent increase in sales volume.

Year-over-year, only multifamily saw an increase in total square footage sold, but it was an increase of less than 1 percent and was offset by a 9 percent decrease in sales volume.

Hospitality fared much worse on a year-over-year basis compared with its first quarter rally. It saw a 49-percent decrease in total square footage sold and a 55-percent decrease in sales volume.

Likewise, industrial and retail saw year-over-year figures fall dramatically by 66.6 percent and 38.6 percent in total square footage sold, and 65 percent and 85 percent in sales volume.

Depressed sales numbers and a 14-percent vacancy rate creates an unattractive proposition for developers.

“It would be crazy to start a project with the high office vacancy,” Petersen said.

Read more