Silicon Valley’s office availability saw a sharp increase due to substantial givebacks by large tech companies, according to a second-quarter report by Savills. But despite the increase in available space, landlords are still attracting premium prices.

The availability rate increased by 3.5 percent from 23.1 percent in the first quarter to 26.6 percent in the second quarter. Available sublease space has also continued to increase, ending the quarter at a new “historical high” of 7.6 million square feet, up 55 percent from 4.9 million square feet reported a year ago.

“With the entire technology sector in a correction, office availability in Silicon Valley is at an all-time high and is expected to increase even further as return to office rates have lagged the rest of the country despite high-profile corporate announcements,” the report said.

The largest office giveback came from Google who put more than 1.4 million square feet on the market for sublease. Meta and Roku also put space back on the market. Offloading square footage hasn’t kept pace with new leases on the market.

“Big companies are dumping space on the market with almost no takers,” Craig Petersen from Kidder Mathews said. “We are seeing more activity in the small office markets.”

Leasing activity has remained low at just under 668,000 square feet, down 35 percent from 1 million square feet reported last quarter, as well as down 52 percent from 1.4 million square feet a year ago. The suppressed leasing activity has not affected prices, as the overall average asking rental rate increased to $5.18 per square foot per month, up from $4.99 per square foot last quarter.

Rents have been elevated, because a lot of the space available in Silicon Valley is “high-end” and it would be difficult for landlords to cover debt payments if they lowered rents.

“Usually, when availability and vacancy levels go up, rents go down,” Michael Soto, head of office research at Savills, said. “But rents have been very sticky as many landlords have offered high concessions in order to keep their face rents high. In addition, there are a lot of office landlords out there who simply cannot drop their rents because of debt covenants with their lenders.”

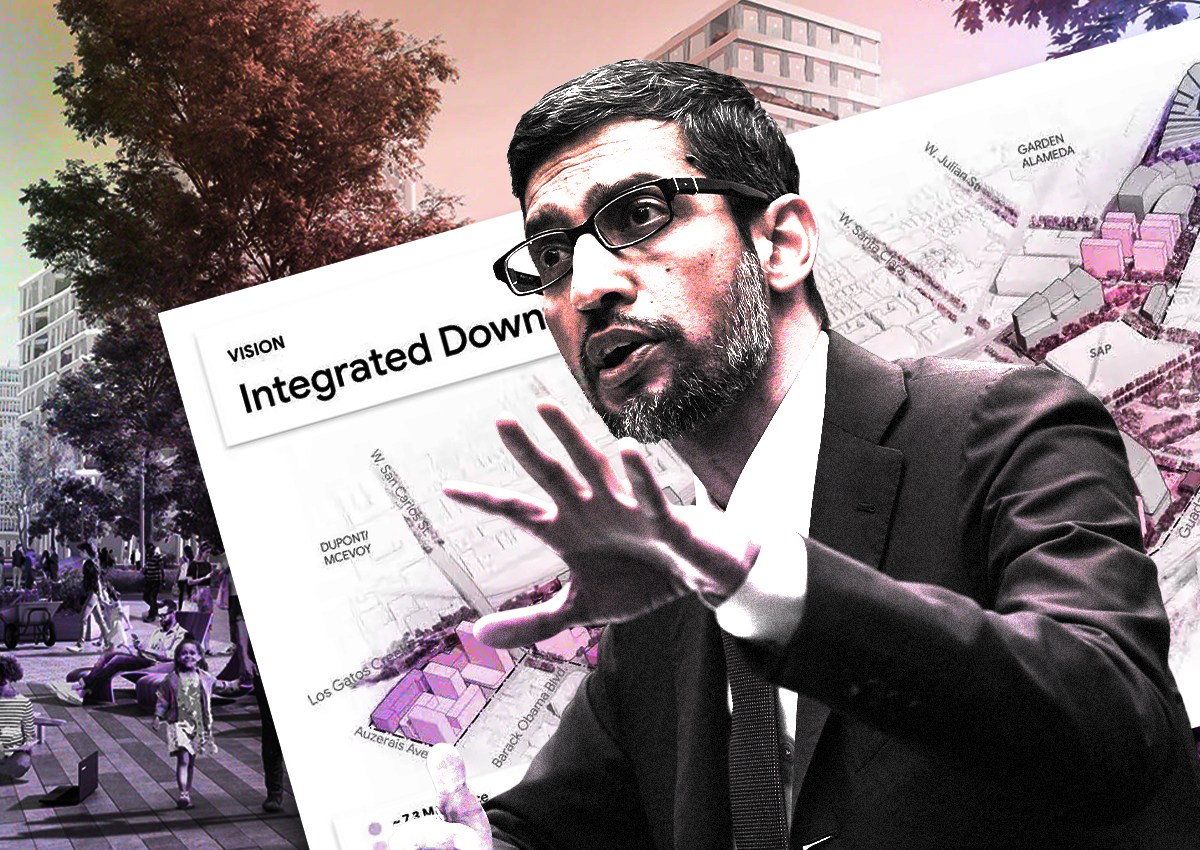

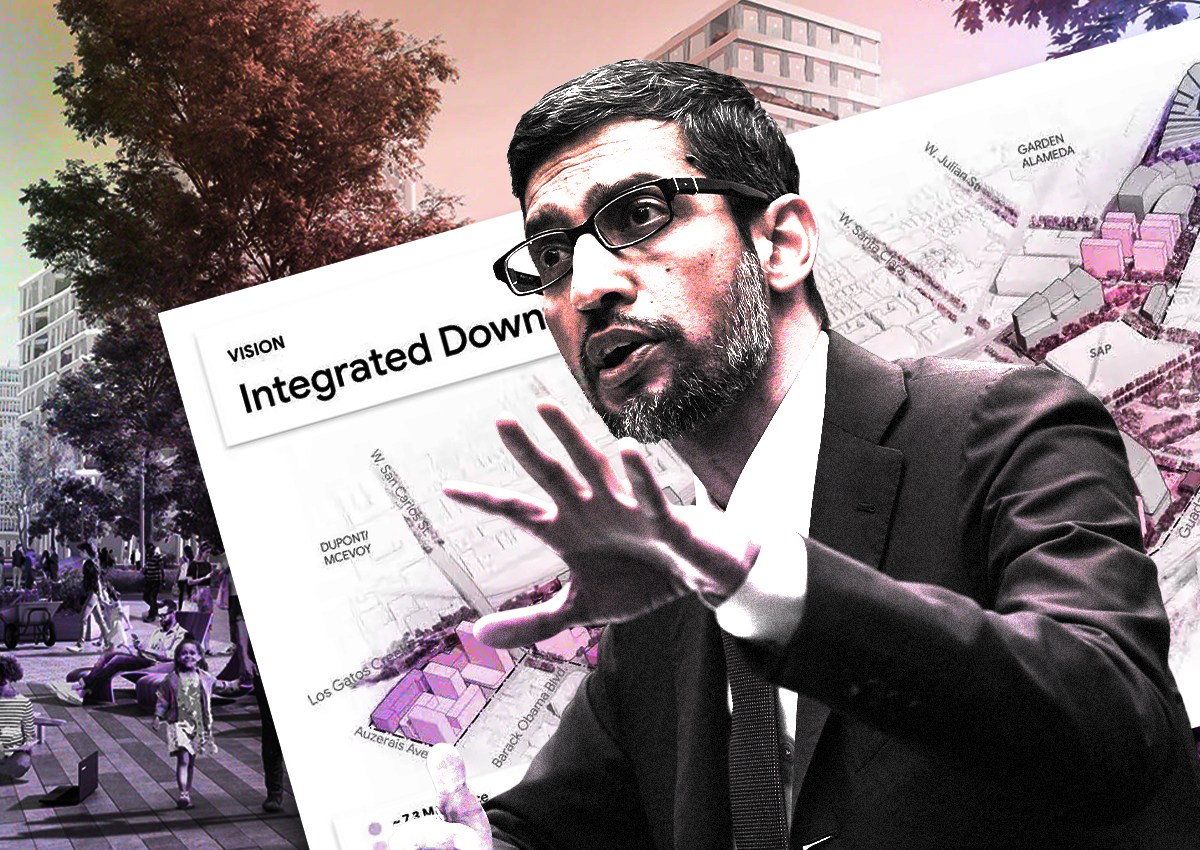

Companies are not only offloading space, but also stopping major construction projects that could reshape Silicon Valley. Google has halted its Downtown West project in San Jose. The development near Diridon Station was to include 4,000 homes, 7.3 million square feet of offices, 500,000 square feet of shops and restaurants, a community center and 15 acres of parks. Google’s reassessment was partly due lagging return to office trends in Silicon Valley which contributes to a stagnating office environment.

“All new development was put on hold when the pandemic arrived and they are not starting up due to extremely high office vacancy, not just Google’s project,” Petersen said. “It would be crazy to start a project with the high office vacancy.”

Read more