Silicon Valley’s office market as a whole continues in distress as companies grapple with remote work trends and offload underutilized space. On the other hand, cities that host the giants of the tech industry are holding up better than the overall market.

Office availability in Silicon Valley rose to 20.4 percent in the second quarter, from 17.2 percent in the previous quarter, according to a report by CBRE. Asking rents and leasing activity also dipped in the most recent quarter. The markets with the largest availability rates were Downtown San Jose and Santa Clara, which both stood at 28 percent. Their vacancy rates were also the largest in Silicon Valley at 26 percent, and they both had an average asking rate under $5, which was below other submarkets.

In contrast, smaller cities with a large tech presence have fared much better. Cupertino and Milpitas have availability rates around 5 percent, while Sunnyvale stands at 14 percent and has the third-highest asking rent at $6.65. The strength of these markets revolves around the headquarters or large office footprints of Meta, Google and Apple. These companies continue to make investments in these markets.

“Sunnyvale and Cupertino are markets where big technology users prop up occupancy and continue to work in the office, reducing the fluctuation in vacancy,” Nicole So from Colliers said.

“A few cities are doing better than others,” Craig Petersen from Kidder Mathews said. “Cupertino is the best market, and it’s all about Apple. Apple continues to expand; they just purchased a big building, and they are building another. Companies that sell to Apple are also active in Cupertino as are startups funded by former Apple employees.”

Sunnyvale and Cupertino also benefit from prime locations on the Peninsula.

“Both Cupertino and Sunnyvale continue to experience lower vacancy levels due to the desirability of these respective locations, quality of real estate and easy access to the 101, 85 and 280 Freeways,” Mark Christierson from CBRE explained.

Palo Alto and Mountain View have the highest asking rents in the market at $8.77 and $8.29, respectively. However, these cities have lost some luster with availability rates of 26 and 21 percent respectively.

“Downtown Palo Alto and Mountain View are not as active as we have seen in the past,” Petersen said. “They have always been the first to bounce back in a downturn. Access to Caltrain is not the selling point it once was since the pandemic, and the price of office space is extremely high.”

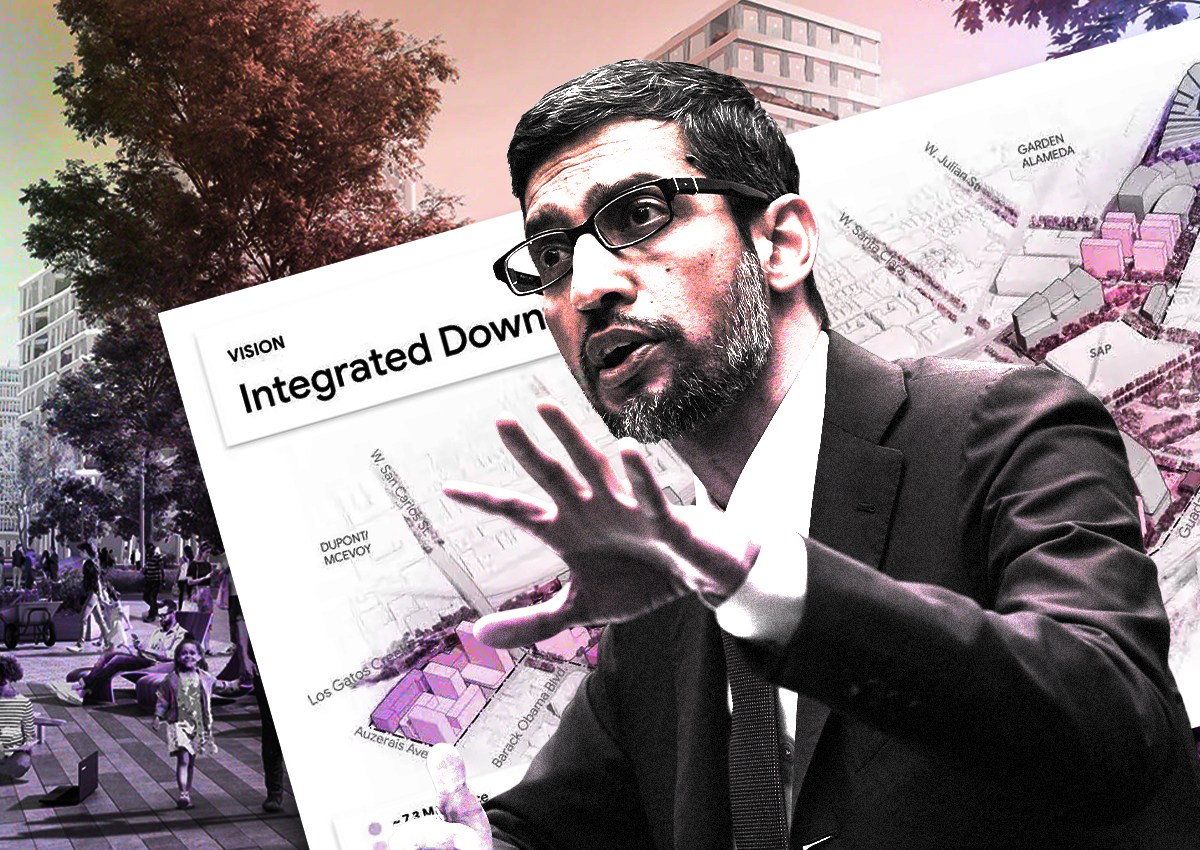

Both San Jose and Santa Clara don’t have the presence of large tech companies, and the decision by Google to halt its massive Downtown West project in San Jose has added to that market’s distress. These cities also have some tough commutes.

“I have seen some resistance to being in Santa Clara because of the traffic on the 101,” Petersen said.

Read more