UPDATED OCT. 3 at 5:00 p.m.:

Call it a real estate boomerang: investors who sold office buildings in San Francisco returning to buy them back for cut-rate deals.

Gaw Capital Partners, based in Hong Kong, and Irvine-based LBA Realty are in separate negotiations to repurchase properties they once owned in the city at steeply discounted prices, the San Francisco Chronicle reported, citing unidentified sources.

The seller is Blackstone Group, based in New York.

In 2018, the private equity firm run by Goodwin Gaw sold a 293,900-square-foot office campus at 560-655 Davis Street in Jackson Square to Blackstone for $245 million, or $833 per square foot.

Now, Gaw Capital Partners wants to buy it back — for a third of its pre-pandemic value.

Gaw Capital was chosen to buy the three-building North Park complex from Blackstone for around $90 million, or $306 per square foot, sources told the Chronicle. The four-story brick campus is 40 percent vacant.

In a statement, Blackstone said it “effectively wrote this investment down to zero last year given the well-known headwinds facing U.S. traditional office buildings and the downsizing of the property’s primary tenant in a market with historically high vacancy.”

The office vacancy rate in San Francisco hit a record 33.9 percent in the third quarter during a continued shift to remote work, with office values plummeting across the market.

LBA Realty once owned an 82,000-square-foot office building at 600 Townsend Street in Showplace Square, which Blackstone picked up as part of a portfolio for an unknown sum.

The 115-year-old building was once fully leased by Salesforce and then occupied by Airbnb, whose sublease expired in March.

LBA Realty is now buying back the vacant brick building for just over $24 million, or $292 per square foot.

Blackstone’s decision to offload North Park and 600 Townsend is a “pragmatic” move, sources told the Chronicle. The company is shedding distressed assets to pour its money into higher value properties and growth sectors, or pick up troubled properties at a lower basis, they said.

A Blackstone spokesperson said the company has turned away from traditional offices to invest in “sectors with strong fundamentals propelled by macro demand trends” — such as logistics, student housing and data centers. “U.S. traditional office represents less than 2 percent of our owned portfolio,” the spokesperson added.

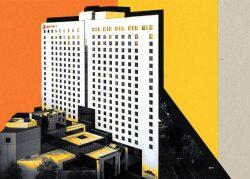

Gaw Capital, run by one of the richest families in Hong Kong, owns a 17-story office building at 555 Montgomery Street in the Financial District. An affiliate, Downtown Properties, owns two other office properties at 300 and 550 Montgomery Street.

ADDITIONS: The previous story did not include some statements from Blackstone on both asset sales.

— Dana Bartholomew

Read more