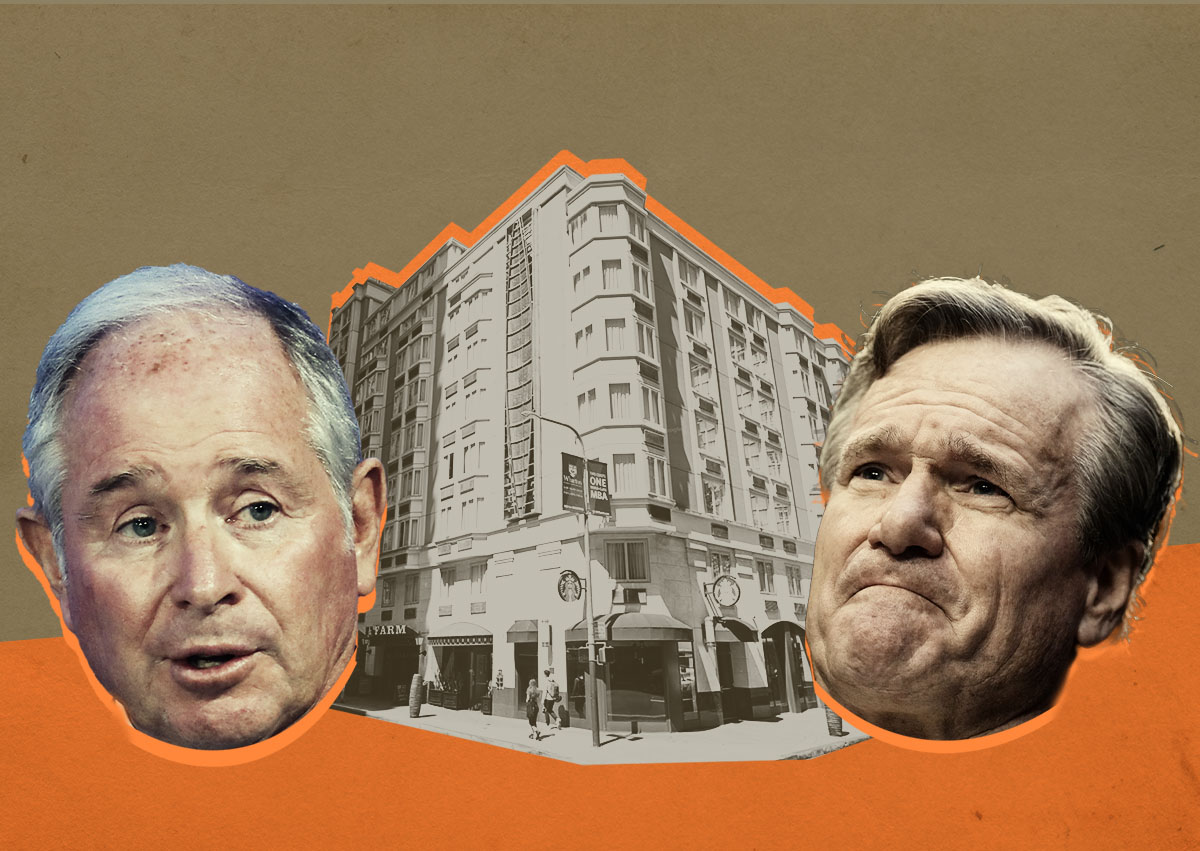

Blackstone wants to give up its 346-room Club Quarters San Francisco hotel after defaulting three years ago on a $274 million loan.

The New York-based investor is in talks with special servicer CWCapital for “a possible deed-in-lieu” for the hotel at 424 Clay Street in the Financial District, the San Francisco Business Times reported, citing a CMBS report.

The special servicer working on behalf of the commercial mortgage-backed securities trust that owns the loan is negotiating similar deeds for three other Club Quarters hotels in Boston, Chicago and Philadelphia secured by the loan.

A deed-in-lieu allows an owner to transfer a property to the lender and relieve it of the responsibility to pay the mortgage debt.

“This was a very small investment that went into special servicing in the summer of 2020 and was written off more than two years ago,” a spokesperson for Blackstone said in a statement. “We are cooperating with all parties involved to ensure a smooth transition of ownership.”.

Blackstone also has a mezzanine loan on its Club Quarters hotels.

Last year from January through June, the mezzanine debtholder was “evaluating alternatives,” including accepting a deed-in-lieu, and was in talks with Blackstone through last February, CMBS reports say.

In August, the unidentified lender sold the mezzanine loan to Masterworks Development, the New York-based developer of the Club Quarters hotel group. It’s not clear whether the four hotels would be given to Masterworks as part of a deed-in-lieu for that debt.

The CMBS loan for the four Club Quarters was made by Bank of America in 2017 after Blackstone bought the hotels the prior year for $283 million. It was set to mature in November 2019, but Blackstone received a one-year extension.

In June 2020, the loan was transferred to special servicing for “imminent monetary default,” according to CMBS reports. Washington, D.C.-based CWCapital had pursued foreclosure on the properties since May, according to the Business Times, when its negotiations with BofA stalled.

Read more

The hotel portfolio had an appraised value of $360 million in October last year, compared to $444 million in late 2017.

The value of the 123-year-old Club Quarters San Francisco rose to $160.8 million, the only hotel in the portfolio to appreciate in six years. In June, the hotel had an occupancy of 58 percent, according to loan reports.

In late September, hotels across San Francisco were 83 percent full during well-attended business conferences, according to CoStar.

— Dana Bartholomew