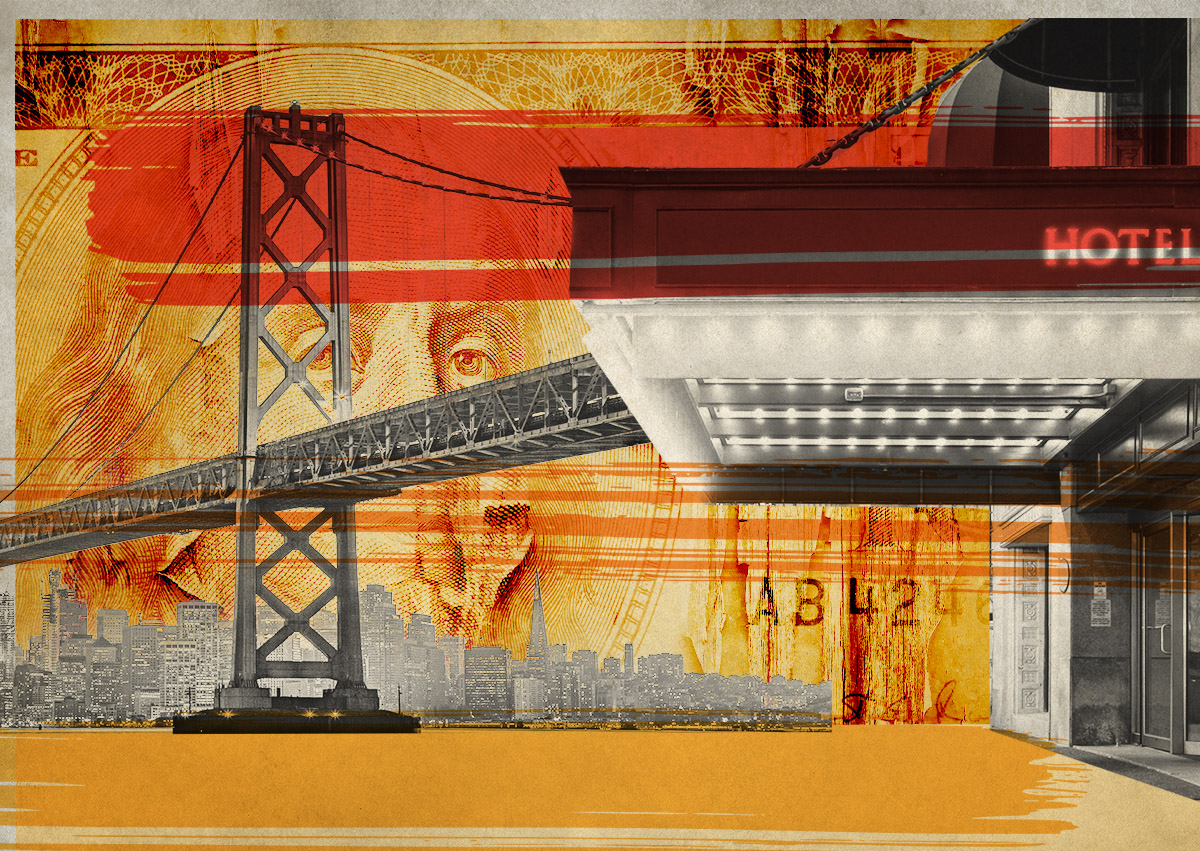

A distressed San Francisco hotel has lost 25 percent of its value in less than a year, according to special servicer reporting.

The Club Quarters in the North Financial District was worth $160 million in October 2022 and appraised at just $120 million in June last year, according to a Morningstar report on the recently released special servicer notes.

Blackstone bought the San Francisco hotel near the Embarcadero along with three others in Boston, Chicago and Philadelphia from Masterworks Development, an affiliate of Club Quarters, for $283 million in 2016. It got nearly $274 million from commercial mortgage-backed securities on the deal in 2017, but stopped payments just months into the pandemic and the loan has been in special servicing ever since. Masterwork bought $61 million in mezzanine debt on its former properties at a discounted price last year.

Only the San Francisco hotel lost value in the most recent appraisal of the four-hotel portfolio, illustrating the difficulties the city has had in the recovery of its hospitality sector. In fact, the other three hotels gained a small amount of equity between October 2022 and June 2023, according to the Morningstar report.

The entire portfolio was valued at $325 million that month, down 10 percent from an appraisal of $360 million the previous fall, with the San Francisco hotel entirely accountable for bringing down the overall value.

Business travel market

The report noted that the Club Quarters is a business travel hotel, which may be one reason its San Francisco valuation is so depressed.

According to the city’s tourism association, SF Travel, there were nearly 50 events at the Moscone Convention Center in 2019, compared to about 35 in 2023. Only 21 events were slated for 2024, accounting for 426,951 hotel room nights, down 34 percent compared to 2023 and 55 percent from 2019.

San Francisco is one of the few destinations where hotel room rates have not recovered to pre-pandemic levels, said Emmy Hise, senior director of hospitality analytics at CoStar Group. The San Francisco average daily room rate in 2023 was $223, a 6 percent increase over 2022 but about 10 percent lower than 2019 figures.

“If inflation was factored in, the hotel rate recovery would look worse,” she said.

On the other hand, San Francisco still has one of the highest average daily rates in the country, she said, with few destinations breaking the $200 mark on an annual basis. Last year, San Francisco’s revenue per available room growth or RevPAR was higher than Chicago and Philadelphia, but below Boston and New York.

The most likely buyer of the Club Quarters debt would be an investor “that believes they are receiving a discounted price and has the cash to hold the properties until the markets and capital market environment recover to more favorable terms,” she said.

Club Quarters’ North Financial District location makes it part of CoStar’s Nob Hill-Fisherman’s Wharf submarket, where occupancy was 83 percent prior to the pandemic and now has a 12-month occupancy average of 69 percent, the second highest in the city. The adjacent Market Street submarket, which includes Moscone, was at 82 percent occupancy in 2019 and has only recovered to 61 percent — the lowest occupancy of the city’s submarkets. But its 12-month average daily rate is the highest at $254, only $17 off 2019 levels.

Hise said she wouldn’t be surprised if most hotels in San Francisco have declined in value, though she couldn’t say if 25 percent was an accurate figure. The value is impacted by macro-economic factors such as the higher cost of debt as well as the city’s longer recovery period, “which can negatively impact cash flow and, therefore, pricing and capitalization rates.”

To bring values back, interest rates would need to come down and hotel performance would need to come up, not just with a return in business travelers, but international and leisure visitors as well, she said.

The city’s hospitality recovery should get a boost from some upcoming “mega events” such as the 2025 NBA All Star Game at Chase Center and the 2026 Super Bowl, which will actually take place in Santa Clara at Levi’s Stadium. Santa Clara will also host six matches during the 2026 FIFA World Cup, which could bring international travelers to the city. She noted that San Francisco “got good feedback after hosting DreamForce and APEC, which could hopefully help improve the negative perception of the city and bring travelers back.”

Read more