Allstate is holding its toe over the California insurance market — but will resume writing new homeowner policies only if the state enacts regulations demanded by the industry.

The Illinois-based insurance firm indicated at a public workshop held by the California Department of Insurance that it’s getting ready to resume writing new policies in the state, the San Francisco Chronicle reported.

The state’s fourth-largest home insurer stopped writing new homeowner policies in November 2022 because of wildfire risk, the cost of rebuilding homes and the rising price of reinsurance, or insurance for insurers. The company continues to renew existing policies.

In June, Allstate received a go-ahead to hike homeowner premiums in California by 4 percent, but said it had no plans to reverse its decision to stop writing new policies in the state.

Now it has reconsidered because of a pending regulatory overhaul.

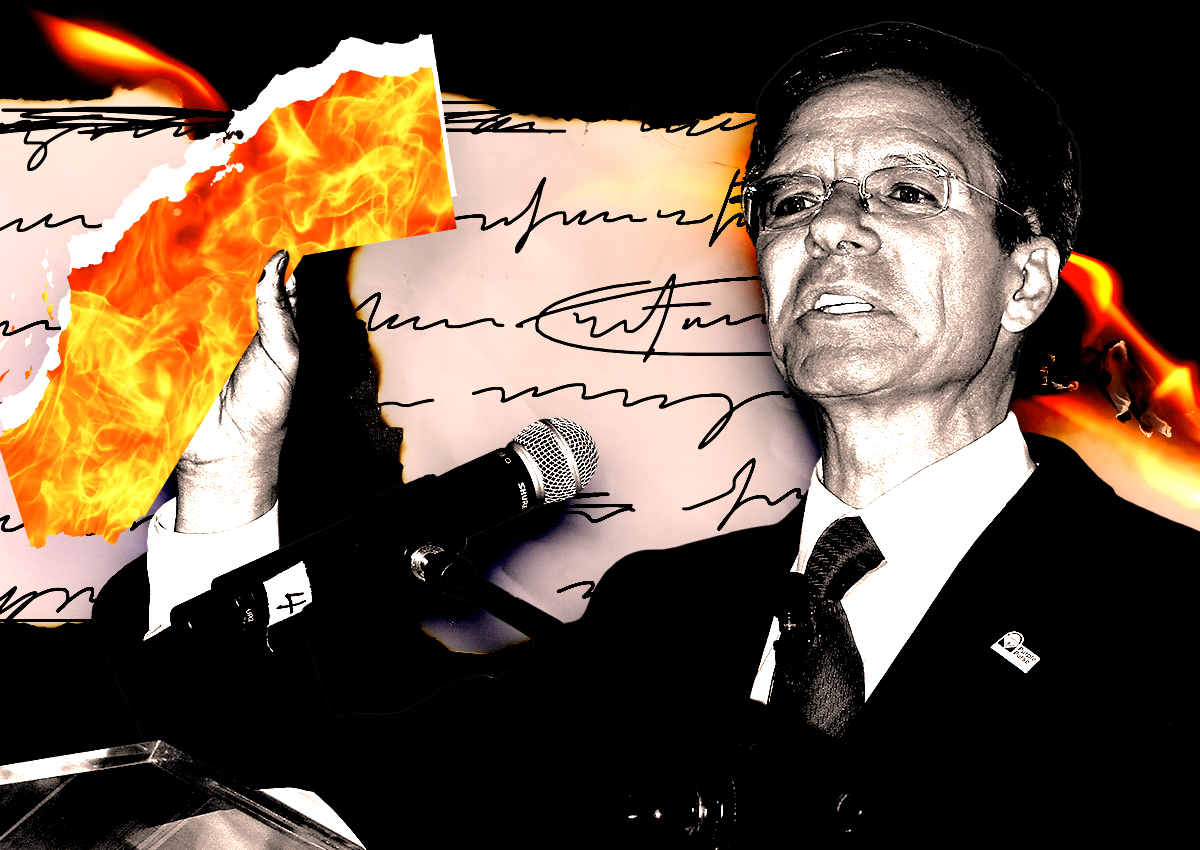

Once California enacts a slew of insurance regulations, “Allstate will begin writing new homeowner insurance policies in nearly every corner of California,” Gerald Zimmerman, the company’s senior vice president of government and industry relations, said at the workshop.

“If the regulations were in effect today, we would begin selling new homeowner insurance policies tomorrow.”

Insurance Commissioner Ricardo Lara has created a Sustainable Insurance Strategy — the largest insurance reform in the state in more than 30 years — to lure insurers back to the market.

Allstate didn’t give a timeline for when it could resume writing new policies, but said in a statement it would “first need to be able to fully reflect the cost of providing protection to customers.”

The state Department of Insurance plans to enact all regulations by December, though it could take longer for insurers to take advantage of the reforms.

The regulation strategy comes as a trade-off, according to Harvey Rosenfield, founder of nonprofit Consumer Watchdog. Insurers may come back, but with much higher rates.

Allstate insures about 350,000 homeowners in the state, along with nearly a million drivers, Zimmerman said.

It’s one of many large and small insurers that have either stopped writing new policies or left California, citing rising costs and risk.

It’s also the first major insurer that stopped writing new policies to publicly announce plans to ink new policies in response to coming reforms, according to Rosenfield.

State Farm, California’s largest home insurer, stopped writing new policies in May. This month, Tokio Marine America Insurance and Trans Pacific Insurance announced plans to withdraw from the state beginning in July.

The exodus adds to a growing list of major insurers across the Golden State that are ending or whittling down coverage during heightened risks posed by wildfires and other natural disasters fueled by climate change.

A few weeks ago, State Farm General Insurance said it would not renew 72,000 policies in July, nine months after announcing it would stop offering new coverage.

Other insurance companies have either paused new policies or will no longer offer new ones, including Allstate, The Hartford, Farmers Insurance and United Services Automobile Association.

— Dana Bartholomew

Read more