A year ago, a local developer surrendered a San Francisco site approved for 460 apartments to its lender, Washington Capital Management, which has now relaunched the project with a bigger home count.

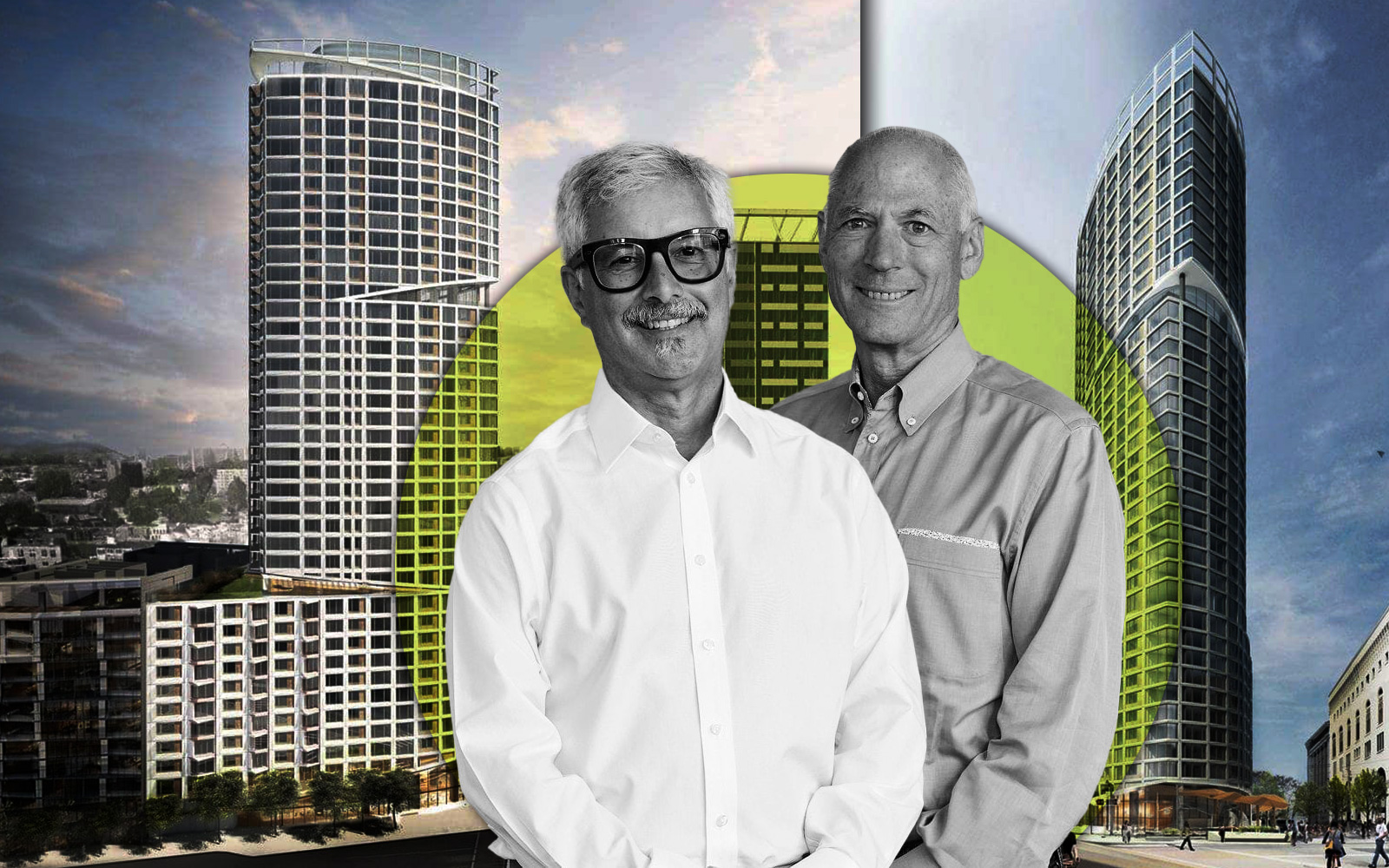

The Seattle-based investor teamed up with locally based Emerald Fund to relaunch the 40-story project at 1500 Market Street with 56 more homes, the San Francisco Chronicle reported.

Plans now call for a 437-foot tower on 84 acres at Market Street and Van Ness Avenue, in the Hub District. The height would stay the same, but with a wider girth, the building would contain 516 apartments or condominiums.

The developers would also slash funding paid to satisfy city affordable housing requirements.

It was in April last year that locally based Build Inc., which owed $44 million on the property, filed a deed-in-foreclosure to Washington Capital for its stalled One Oak project.

The 84-acre property at the edge of Civic Center, Mission and South of Market includes a parking lot and a three-story building with a ground-floor cafe. Build bought the parcels for the property in 2015 for $40 million.

The One Oak project was approved in 2017 as a mixed-use, 304-unit tower containing 1,200-square-foot condominiums, with a curved glass facade and public plaza. At the time, the development was valued at $400 million.

But Build couldn’t get investors to bankroll it as construction costs rose faster than home prices. In 2018, the firm tried to sell the site for an undisclosed price.

Two summers ago, the developer turned toward building apartments instead. The city’s Planning Commission approved revised plans to build a 460-unit tower of mostly studio and one-bedroom apartments, averaging 800 square feet.

Washington Capital and Emerald Fund have dusted off the project – which could be sold to a potential developer. But they want to whittle down the $35 million fee that Build agreed to pay in exchange for not adding onsite affordable units.

They seek the 16.4 percent “in-lieu” fee reduction approved by the city last summer that temporarily cut its affordable housing requirements and fees. The proposed alterations will likely not require a public hearing.

The sleekly curved tower, designed by Chicago-based Solomon Cordwell Buenz, is outlined in minimal renderings, with a windowpane pattern over what looks to be floor-to-ceiling windows. A six-story extension would include a terrace deck.

Read more

Marc Babsin, a principal at Emerald Fund, told the Chronicle that his firm is taking an “advisory” role on the One Oak project.

“The question for all development right now is, ‘How do you make it feasible?’” Babsin, who declined to say whether Emerald Fund plans to build the project once the modifications are approved, told the newspaper.

“Once the project is feasible, you can sell it, you can bring in an equity partner — you can do any range of things,” Babsin said. “The first step is getting to feasibility, and this is a step in that direction.”

— Dana Bartholomew