The Pacific Companies is moving forward with the development of 781 units of affordable housing in the Bay Area after closing on four ground leases with Safehold, according to an announcement this week.

Three will be in San Jose, one will be in Concord and all will be low-income tax credit developments. A Safehold representative declined to disclose the addresses of the properties, or any terms, including the length of the ground leases or the price.

The deal marks Safehold’s fifth with The Pacific Companies. All of the ground leases with the Idaho-based multifamily affordable housing developer are in the Bay Area. The Pacific Companies did not immediately reply to a request for comment.

Ground leases are relatively common in markets like New York City, but are less present in the Bay Area. Unlike the ground leases of the past, which were largely initiated by a landowner who was not necessarily a developer, companies like Safehold now buy the underlying land for a project from the developer, who then gets a new source of capital for the project. Though the developer has to pay ground rent on the land, that cost is typically lower than a traditional loan.

Safehold’s head of investments, Steve Wylder, said that the company’s “highly accretive, long term capital” is helpful in bridging capital stack gaps and lowering costs compared to a typical fee simple transaction.

“It’s a tool to help projects move forward,” he said.

Safehold is a New York-based REIT with a portfolio of $6.5 billion in ground lease investments over 135 transactions in 40 markets nationwide, according to its website. The company, which went public in 2017, has ground leases on over 18,000 multifamily units, 12.5 million square feet of office, over 5,000 hotel rooms and 1.3-million square feet of life science. The company has recently been expanding its presence in the affordable housing sector, Wylder said.

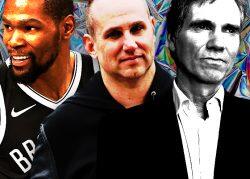

Some of the celebrity investors in Safehold’s Caret Ventures subsidiary include former Golden State Warrior Kevin Durant and Fanatics founder Michael Rubin’s family office.

Read more